Companies and organisations successfully rely on d.velop invoices.

Features of Digital Invoice Processing

Discover the possibilities of digital

invoice processing

The manual handling of incoming invoices costs companies valuable time every day and leads to unnecessary expenses. With the partial introduction of mandatory e-invoicing on January 1, 2025, the pressure to act is increasing: those who fail to digitalize now risk not only inefficiency but also compliance violations. Take this opportunity to future-proof your invoice management. Simplify and automate your invoice processing workflow:

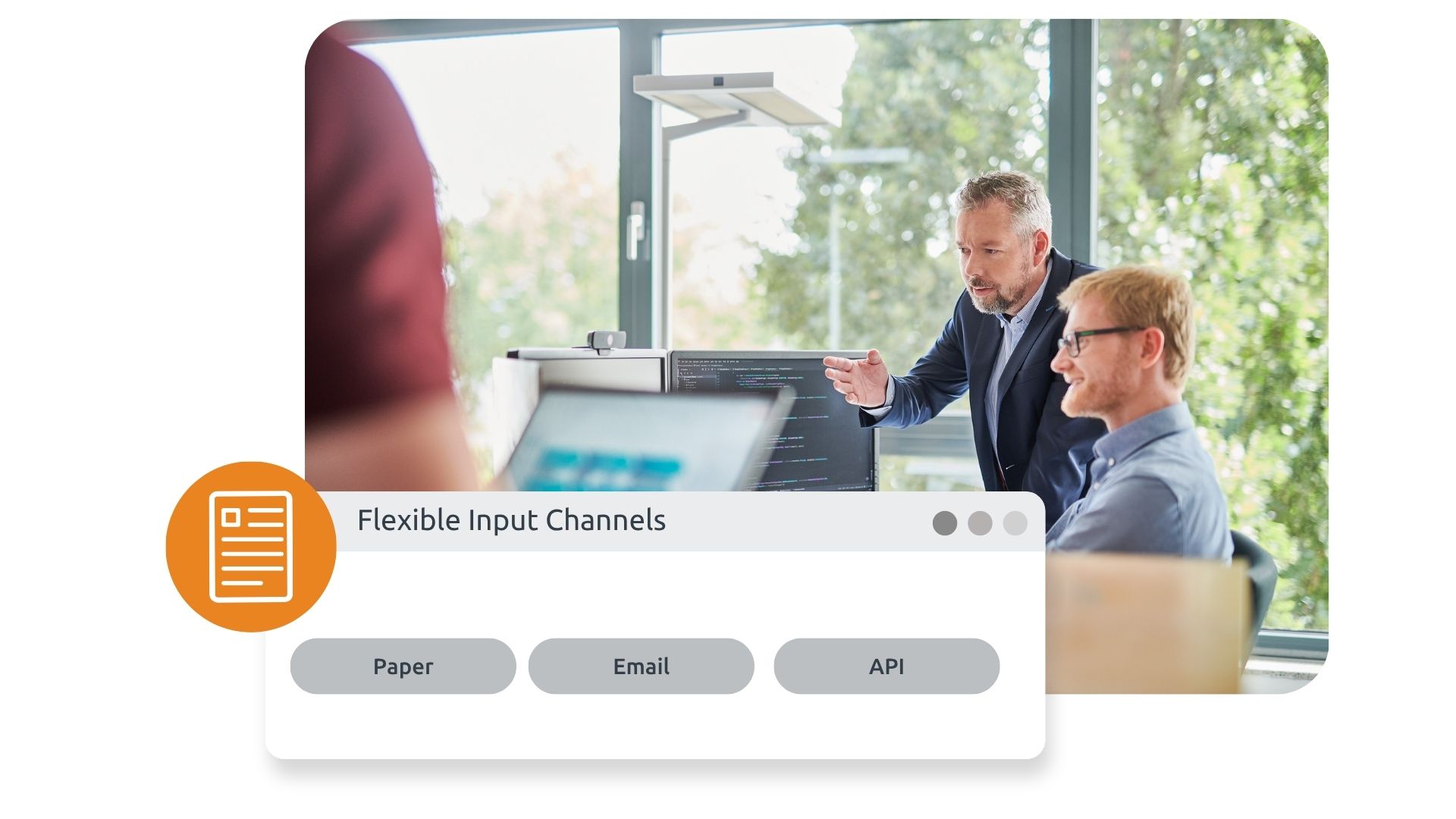

Invoice receipt: Import via flexible input channels

Paper documents are scanned, digitised as PDF files and imported. If an invoice is received in digital form by email – for example, as an XRechnung or in the ZUGFeRD format – it is automatically transferred into the software without any manual effort.

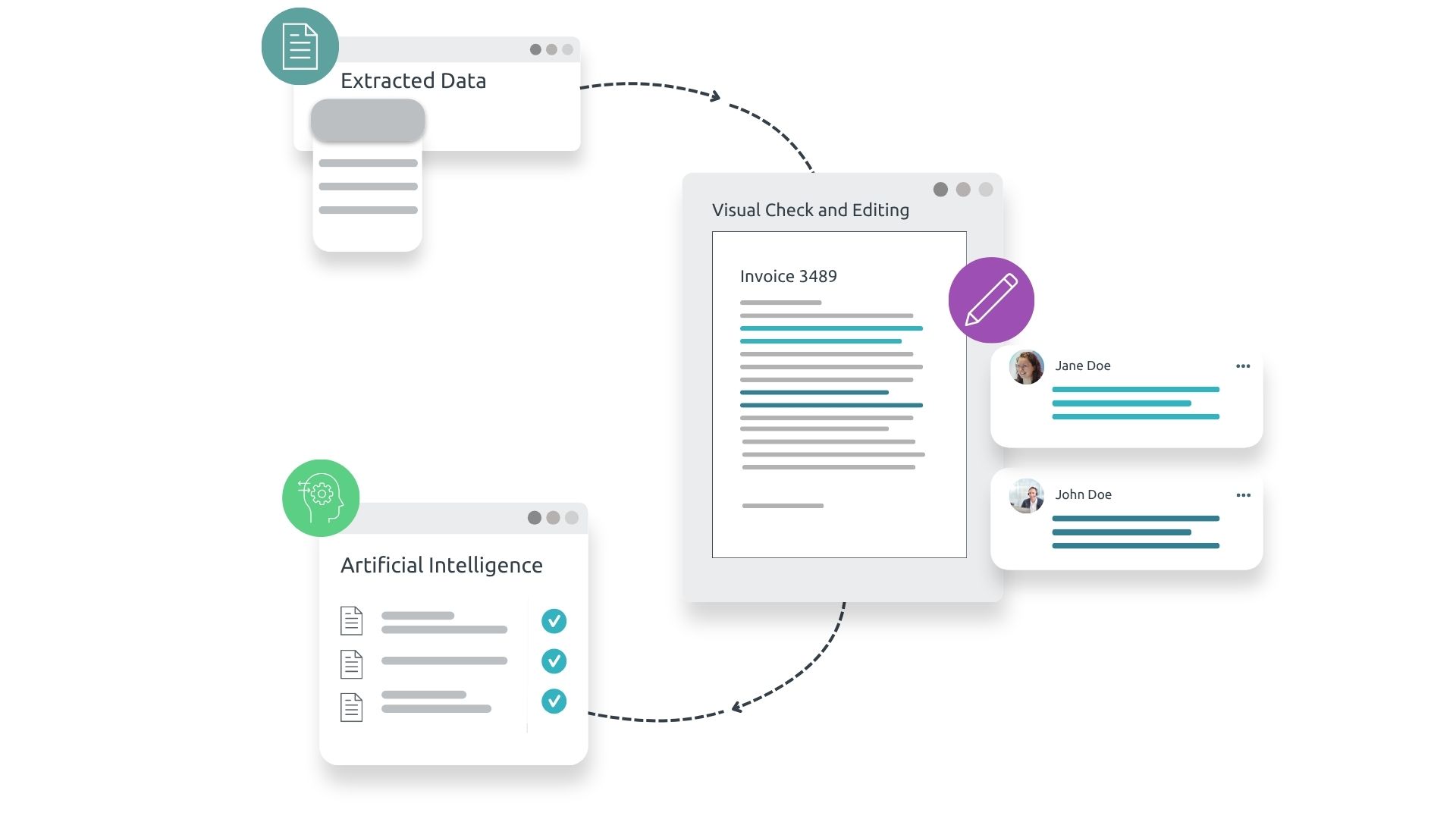

Invoice recognition: Reading and extracting data

All relevant information, such as header, footer and line-item data, is automatically read from the invoice and made available anytime and from anywhere. Manual typing and data entry are therefore a thing of the past.

Data verification: Visual check supported by AI

After recognition, the extracted data is available for review and, if necessary, editing. Users are supported by Artificial Intelligence (AI), which continuously learns independently from their inputs. As a result, the software becomes increasingly intelligent over time, steadily improving recognition rates.

Invoice White Paper

Digital invoice processing – tips and pitfalls in project planning

Is digital AP invoice processing only worthwhile for large companies? What if AP invoice processing were cheaper than many think and implementing a solution far easier than expected? Why not get started with processing your AP invoices digitally?

This white paper explains the advantages you gain, the possible obstacles you may face and describes the necessary framework conditions you need to have in place.

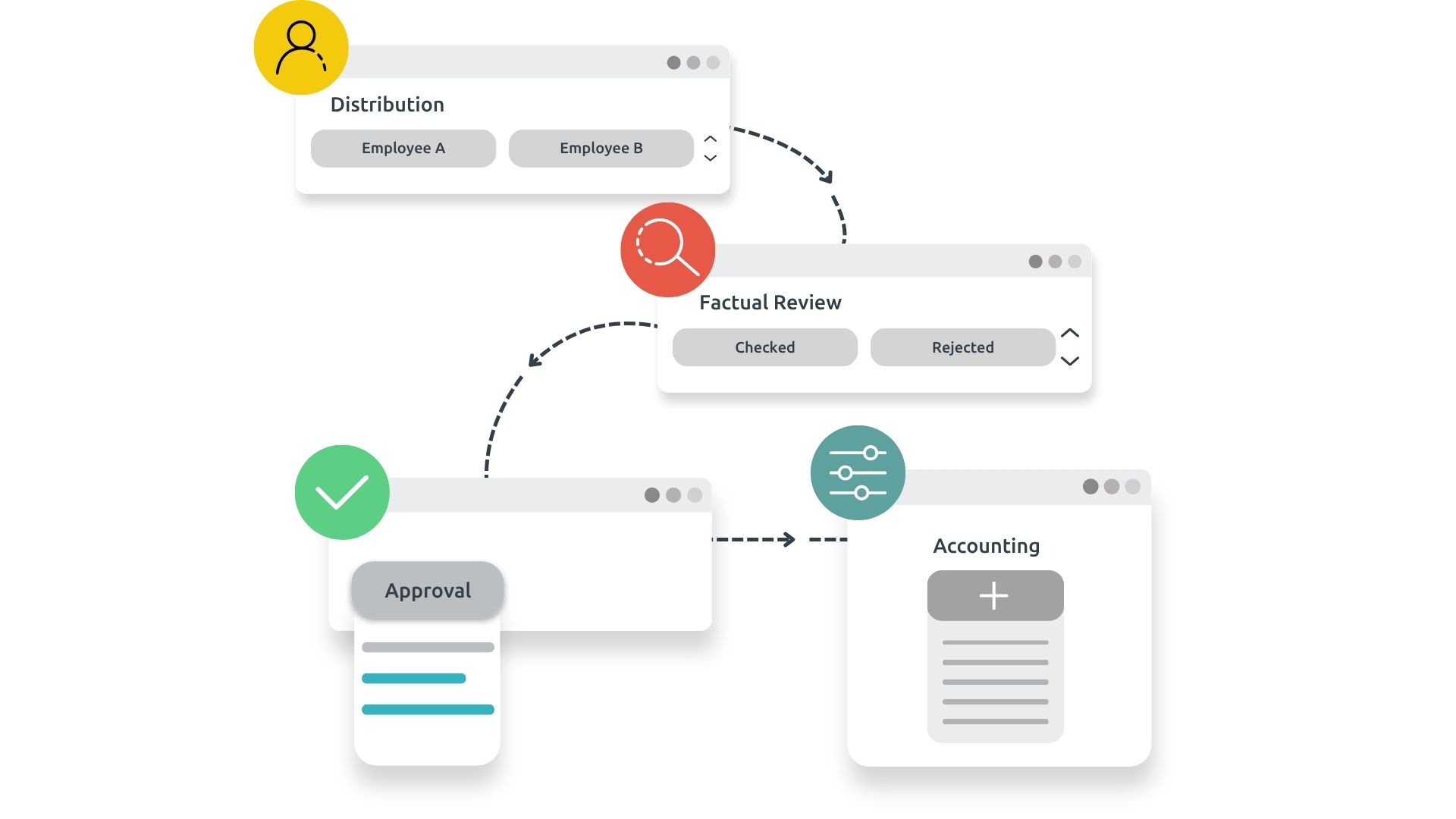

Invoice workflow: Review, approval & posting

Both the digital approval workflow and the conditions for the individual (review) steps can be customised according to your requirements. Design approval processes according to your rules. Thanks to an automatic 3-way match, laborious manual reconciliations are eliminated, and with the clear due-date management and discount traffic light, you always have all discount deadlines in view.

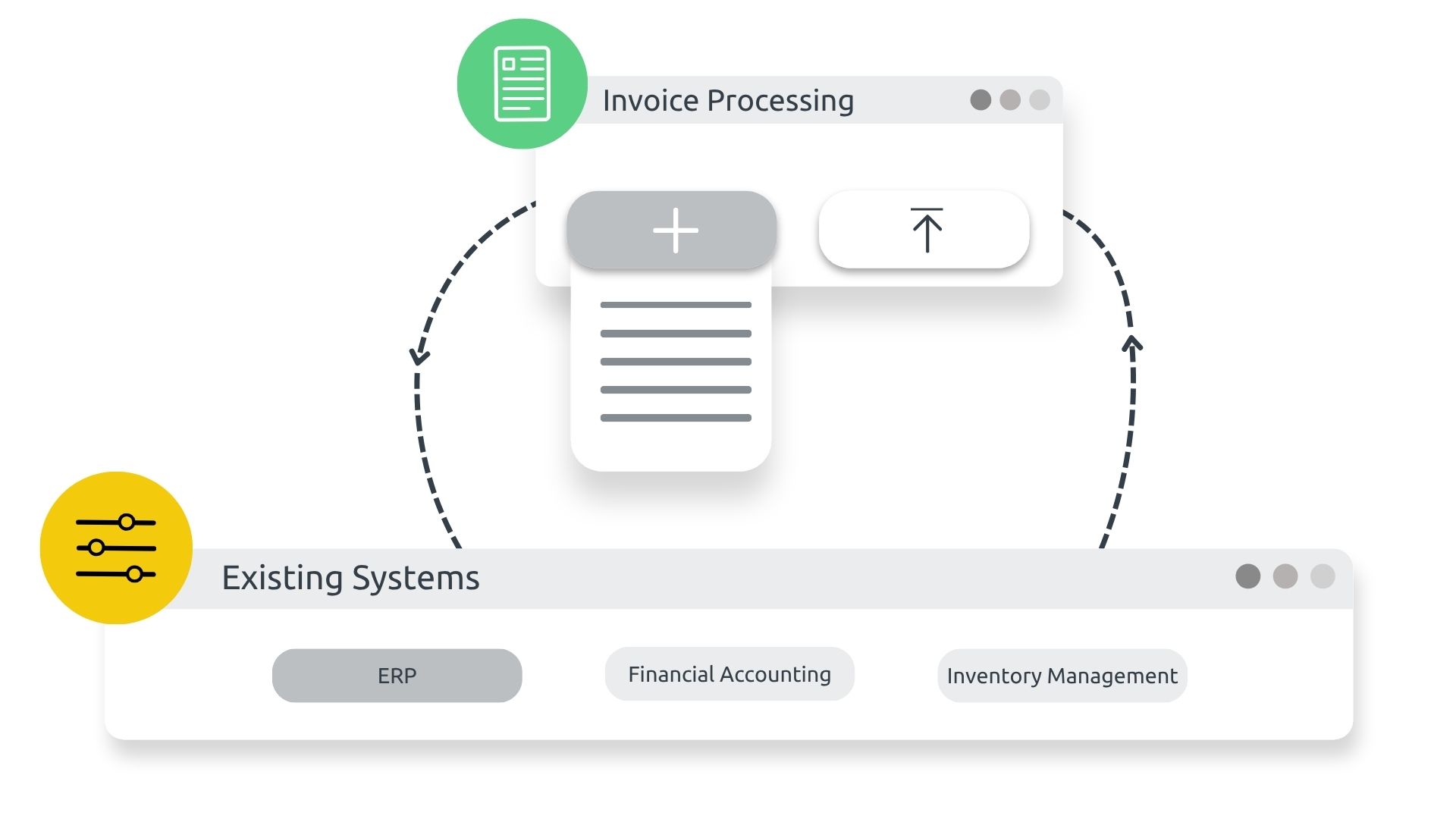

Interfaces: Seamless integration with existing systems

Digital invoice processing integrates seamlessly with your existing systems (ERP, financial accounting & inventory management) and is directly connected to your purchasing processes and accounting workflows.

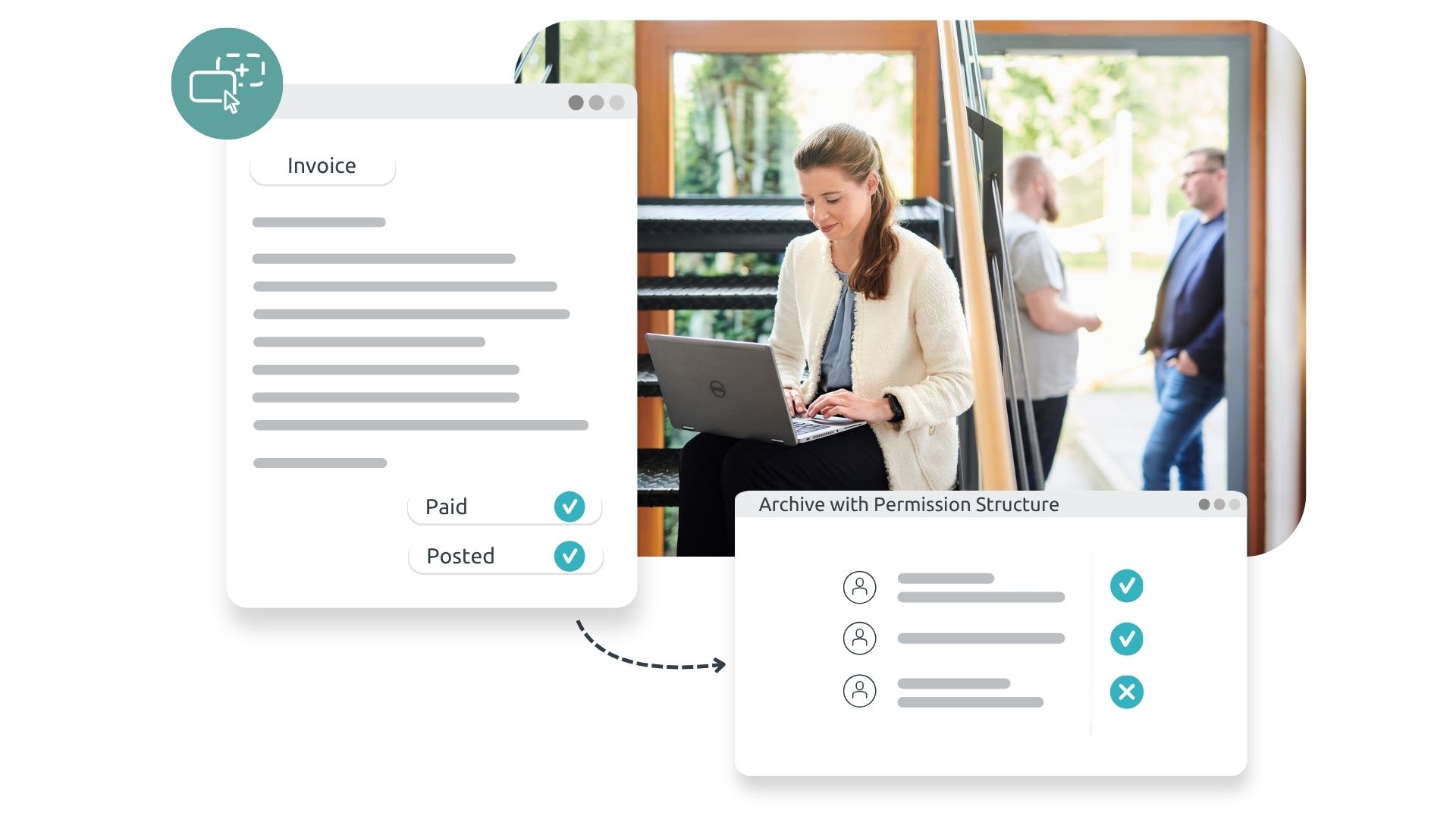

Audit-proof archiving: Keep all invoices in view

Posted invoices are stored in an audit-proof digital archive and can be accessed at any time from anywhere. Access is controlled through individual permission structures.

Digital Invoice Processing Integrations

Seamlessly integrate digital invoice processing into your leading systems.

d.velop’s digital invoice processing is directly connected to your accounting systems and fully integrated into your purchasing processes and accounting workflows. This ensures a simple, fast, and transparent handling of all invoice processes: from factual invoice verification to approval and final posting.

If you use SAP, Microsoft Dynamics, or Microsoft SharePoint, d.velop provides the ideal solution for processing your invoices. It can also be integrated with other ERP systems, ensuring seamless connection to your accounting and purchasing workflows.

Digital invoice processing prices

d.velop invoices cloud pricing packages

Free for 30 days

0 € for 30 days

- All features

- No risk

- Easy onboarding

- No cancellation required during trial

d.velop invoices small

340 € per month plus VAT

- 250 invoices/month

- 5 accounting users

- Unlimited approval users

- Audit-proof archiving

- Automatic invoice data extraction

- Self-service onboarding and eLearning included

d.velop invoices medium

680 € per month plus VAT

- 750 invoices/month

- 10 accounting users

- Unlimited approval users

- Audit-proof archiving

- Automatic invoice data extraction

- Self-service onboarding and eLearning included

d.velop invoices medium

680 € per month plus VAT

- 750 invoices/month

- 10 accounting users

- Unlimited approval users

- Audit-proof archiving

- Automatic invoice data extraction

- Self-service onboarding and eLearning included

d.velop invoices large

1.145 € per month plus VAT

- 1,500 invoices/month

- 20 accounting users

- Unlimited approval users

- Audit-proof archiving

- Automatic invoice data extraction

- Self-service onboarding and eLearning included

d.velop invoices enterprise

2.065 € per month plus VAT

- 3,000 invoices/month

- Including 30 accounting users

- Unlimited approval users

- Audit-proof archiving

- Automatic invoice data extraction

- Self-service onboarding and eLearning included

Got Questions?

Not sure which pricing package is the right fit for your company or organisation? Or do you have more detailed questions? No problem! We’ll be happy to provide you with personal and tailored advice.

Simply fill out the form and briefly describe your enquiry — we’ll get back to you as soon as possible.

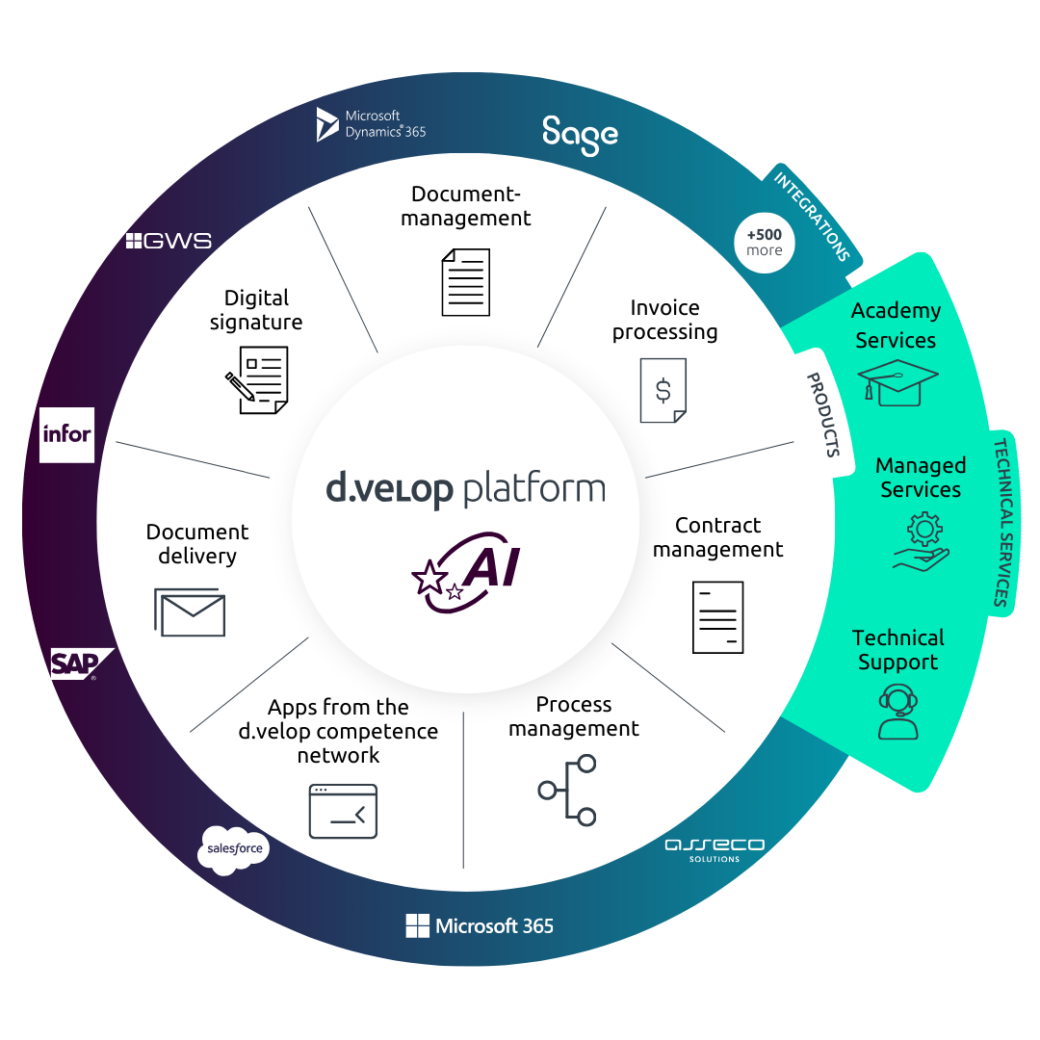

d.velop platform

Unlock the full potential of d.velop.

DMS, ECM, EIM or simply: Connected knowledge

Productive, intelligent, secure: your d.velop tools.

Digitise, structure, store and make information accessible: Our d.velop platform solutions are always tailored to your needs and provide knowledge seamlessly – whether for employees, customers or partners. This not only reduces process costs and time, but also relieves your team and creates space for innovative ideas.

News & Resources

Focus on invoice management

Want to learn more about using digital invoice processing? Here you’ll find news and in-depth information.

FAQ

Frequently asked questions about digital invoice processing

With digital and automated invoice processing, you save both time and money. Faster processing reduces transaction costs, while location-independent invoice verification speeds up workflows. You can also fully digitalise the handover of processes to your accountant. Centralised access to documents in our archive increases transparency across departments. Quick, easy, and legally compliant invoice archiving ensures a seamless process without any media disruptions.

Invoices arrive at a company through various input channels. If they are not yet in digital form, they are first digitised. This is followed by data extraction — the actual invoice recognition. The invoice information is read and matched with your (supplier) master data. Next comes the digital review and approval workflow, followed by transfer to the financial accounting or ERP system, where the invoice is finally posted. In addition, the invoice is stored in an audit-proof archive.

We generally offer a standard approval workflow consisting of distribution, factual review, approval, and accounting. Both the workflow, including the sequence of steps, and the conditions under which an invoice moves to the next review stage can be customised. Approval limits can also be tailored individually. Multiple approval steps with specific limits can be created, or a matrix can be set up for automatically assigning responsible reviewers.

For PDF invoices, this is done using OCR, which stands for “Optical Character Recognition.” OCR captures all the characters on the invoice during digitisation. Using rules and patterns, it extracts key information such as the invoice date, amount, VAT ID, and other relevant details. In combination with artificial intelligence and by using master data, additional data can be derived or validated based on these extracted details. For electronic invoice formats, all data is immediately machine-readable and can be directly transferred into the subsequent processing workflow.

By default, the software interface supports German, English, Portuguese, French, Chinese, Danish, Italian, Croatian, Dutch, Polish, Serbian, Slovak, Spanish, and Czech. Many additional languages are available for invoice recognition. Furthermore, project-specific extensions can be implemented.

Paper invoices can be destroyed if the digital process is classified as GoBD-compliant. This is generally expected with our system, but it must be confirmed by an auditor. A procedural instruction must be created, including technical documentation and further explanations of the invoice processing workflow, which serve as the basis for the auditor’s assessment. Our application has received a software certification according to IDW PS880, confirming that, when used correctly, documents can be stored online in an audit-proof manner. For more information on security, please visit our website. You can decide which documents or folders you wish to archive in a legally compliant, GoBD-compliant way.

Digitalising invoices offers several benefits: it simplifies archiving and quick access to documents, reduces paper usage, and increases efficiency in managing your finances. Additionally, it enhances data security through backup options and makes it easier to comply with legal retention requirements through organised storage.

Contact & Consultation

We Connect Data and People – And Look Forward to Hearing from You.

Curious? We’d be happy to show you our software.

Simply request a live demo.