How financial institutions successfully manage digital transformation with d.velop

In view of the low interest rate level and increasing compliance requirements, hardly any other industry is facing such fundamental changes as the finance and insurance industry. “FinTechs” and “InsurTechs” are addressing new customer groups with selected, lucrative products and modern user interfaces. Thus, increasing the pressure on all market participants. Modern, secure software solutions help you keep up, accelerate your processes while also save costs.

Research Report

Financial services document management beyond 2025

Financial services institutions (FSIs) are under increasing pressure due to rising cyber threats, internal fraud, and the challenges of remote work. At the same time, regulations such as the GDPR and the EU’s new Digital Operational Resilience Act (DORA) demand strict data governance and compliance.

Contents of the Research Report

- How does leadership support document-centric workflows?

- Reducing document manual handling

- Ensuring strategic compliance and security

- Document management innovation

- Digitising document processing

Holistic digitaliSation in businesses

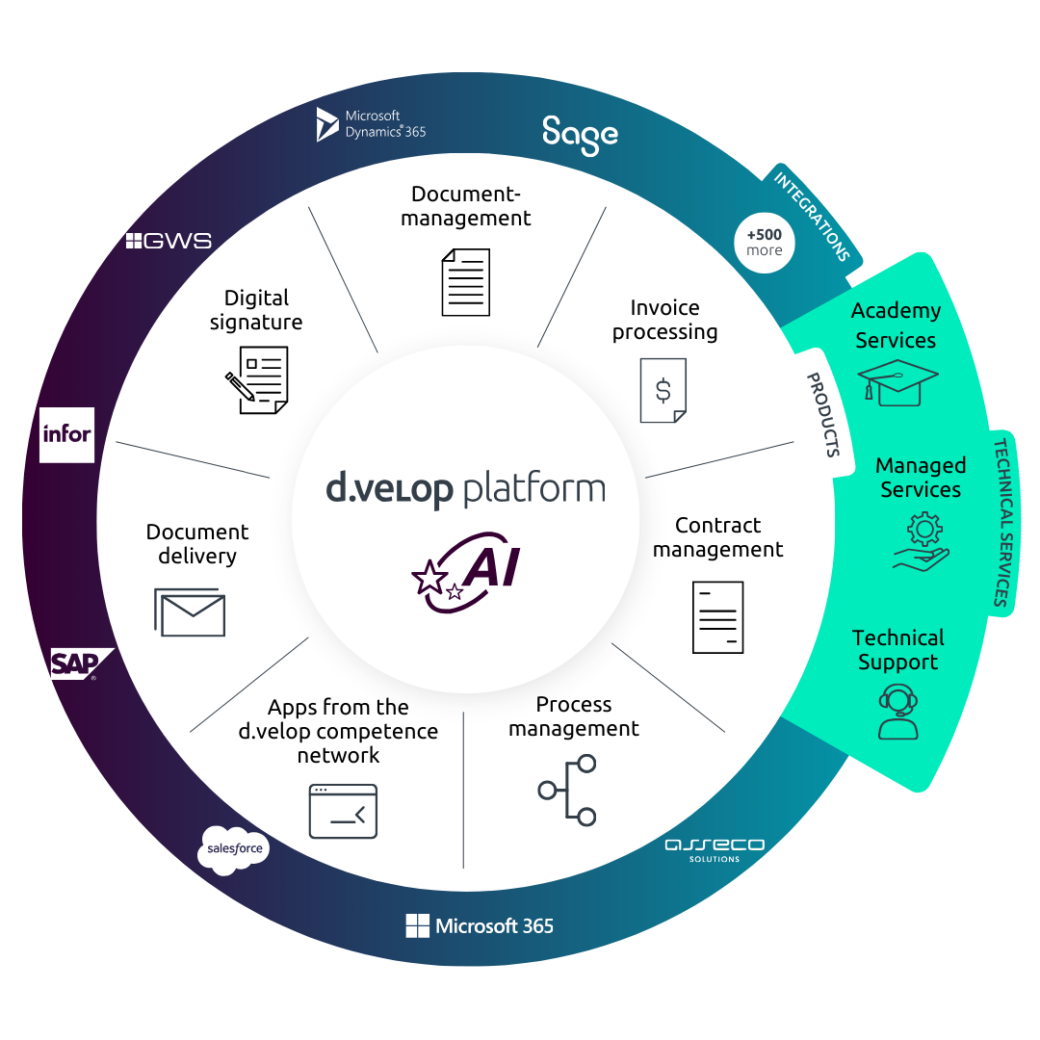

Profit from the d.velop platform

Follow a comprehensive approach to digital transformation. Manual processes that cost employees valuable time become a thing of the past – company-wide.

By implementing the case management with d.velop AG, it gives us an efficient way of working, as the informational flow is the same for all employees. In this way we avoid queries, improve our workflow and have more time for our customers.

Falk Leopold

Head of System- and Workflow Management

Deutsche Anlagen Leasing

3 Tips for Transforming the IT Landscape in 2024

Increasing regulatory requirements, shortages of skilled workers, cybersecurity, and customer demands are placing increasing strain on companies. In this video, we share the top 3 tips for a successful IT transformation in 2024.

The Digital Operational Resilience Act (DORA) is set to transform how financial institutions manage digital risks. As technology becomes more central to financial services, the threat of cyber-attacks grows, and disruptions can have far-reaching impacts. DORA offers a comprehensive framework to ensure the resilience and security of the EU financial sector.

Discover how this regulation can safeguard your business from digital threats and ensure operational stability.

Contact & Consultation

We Connect Data and People – And Look Forward to Hearing from You.

Curious? We’d be happy to show you our software.

Simply request a live demo.