Invoice Workflow with SharePoint Online in Microsoft 365

d.velop provides features with d.velop invoices for Microsoft 365 that automate the digital invoice workflow directly in SharePoint. Speed up your accounts payable processes (coding, review, and approval processes) and keep track.

- Optimization of information retrieval in daily work

- Utilization of the existing Microsoft 365 platform

- Transfer of booking data via standard interface to common ERP systems

- 22 minutes minutes saved with the digital processing of invoices.

- 11 € saved per invoice with a digital invoice workflow.

- 2 days saved in the processing time of an invoice.

Process optimization thanks to seamless system communication

“For us it was most important to find a solution that integrates seamlessly into our Microsoft SharePoint business strategy. Upon recommendation of acoris AG, our solution partner in the Microsoft SharePoint area, we became aware of d.velop AG. With d.velop for Microsoft 365, we finally found the suitable solution platform to gradually implement process optimizations that support us in the company-critical areas.”

Toralf Grimm, IT-Project leader IDEAL Automotive GmbH

Functions & integrations at a glance

Discover the functions and integration options of d.velop invoices for Microsoft 365 and use your familiar Microsoft interfaces and tools to create user-friendly invoice workflows.

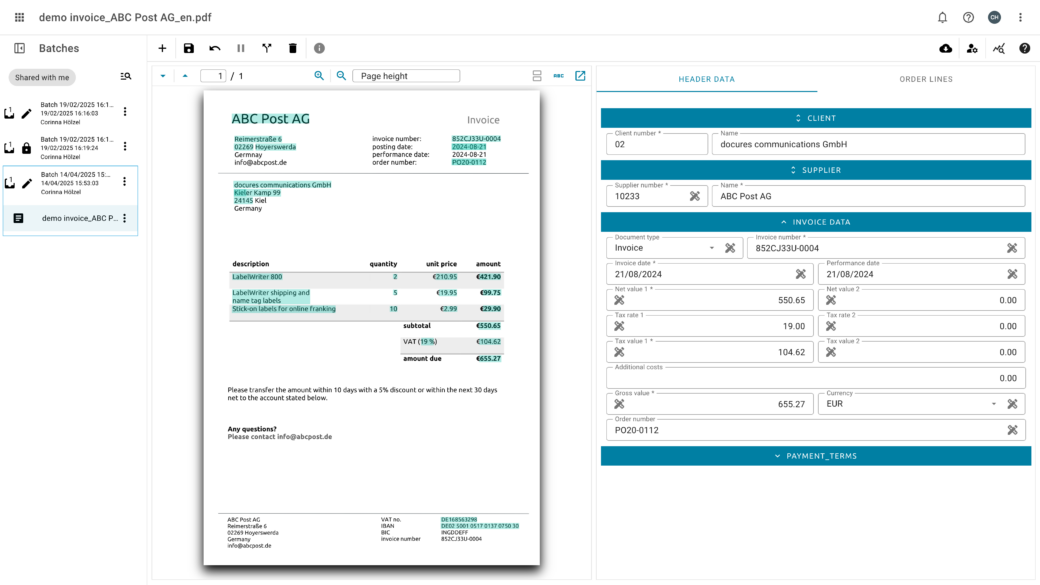

Invoice reader

Read & recognise invoices

- Simply transfer invoices to the software

- AI-based invoice recognition

- Automatic extraction of data

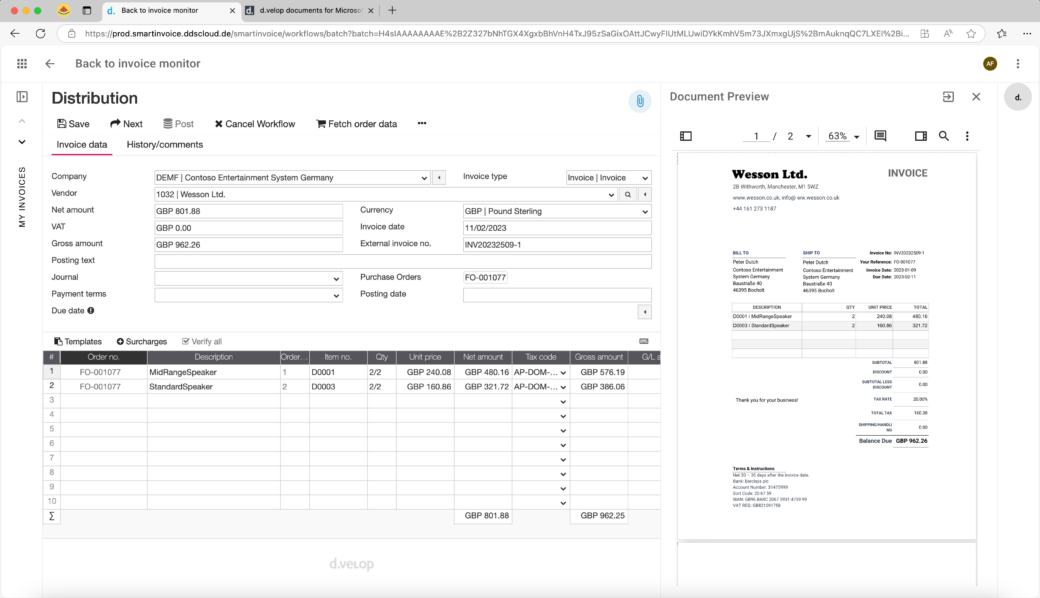

Digital testing process

Simply check & approve invoices

- Support in input and control through artificial intelligence (AI)

- Customised approval workflow according to customer requirements

- Transparent working

- Seamless integration into existing systems (ERP, financial accounting or ERP)

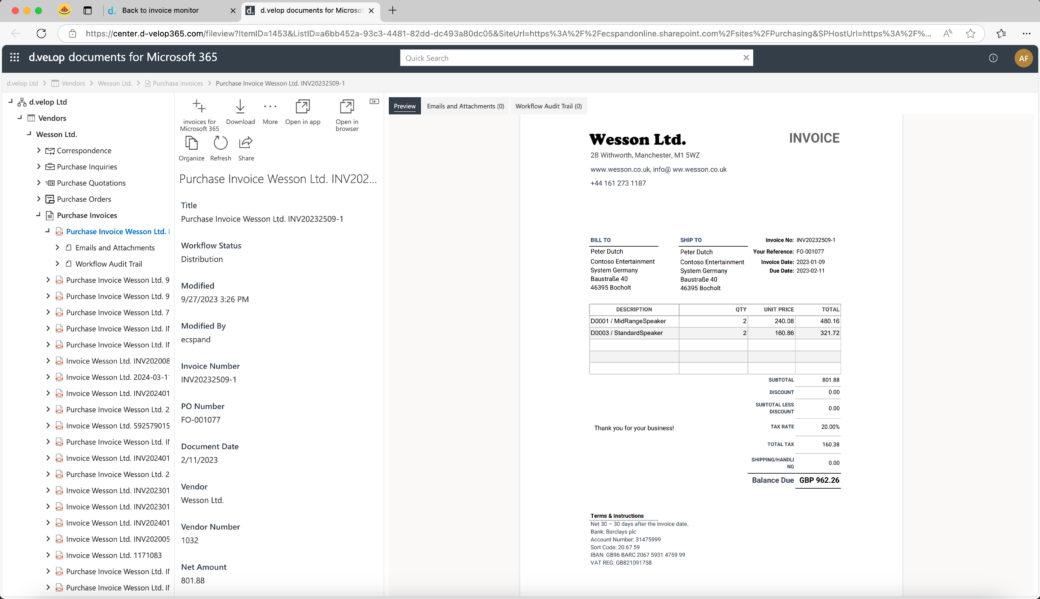

Archiving

Legally compliant storage of invoices

- Audit-proof storage of invoices

- Digital archive

- GoBD-compliant

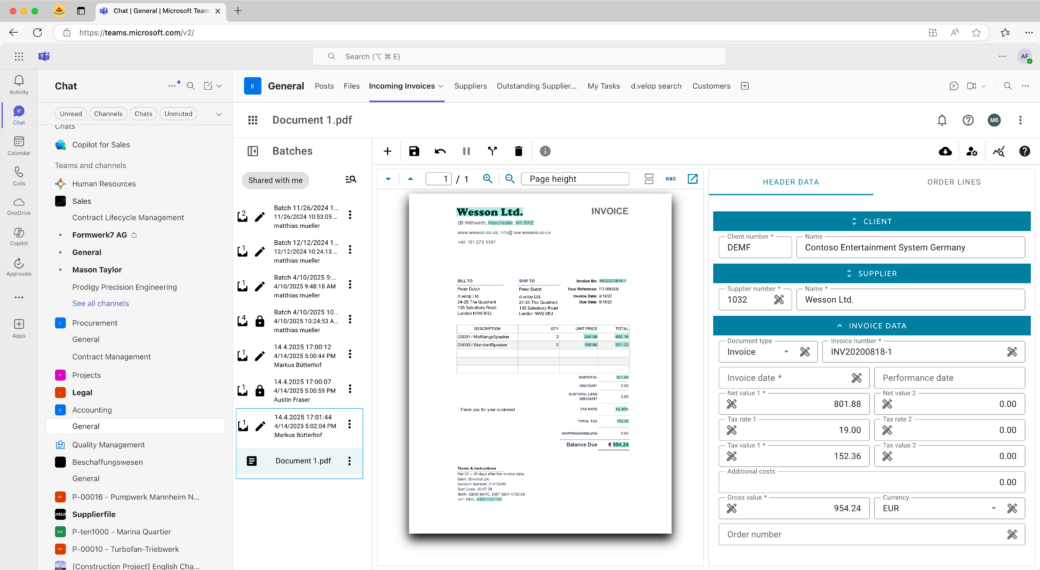

Microsoft Teams integration

All invoice processes can be controlled and accessed directly from Teams

- Transparent overview of your tasks and associated invoices in Microsoft Teams

- Quick access to invoices and information directly from Teams channels in the right context

More content

Do you want to know more about our solutions for Microsoft 365 and SharePoint?

On the d.velop blog, in our webinars and in our whitepapers you will find further information on the topic of digital invoice processing, from best practices and how-to’s to decision guidelines.

FAQ

Frequently asked questions about the digital

invoice workflow in SharePoint

Digital and automated invoice processing not only saves you time, but also money. Faster processing allows you to reduce processing costs. Location-independent invoice verification speeds up the process. You can also fully digitise the process handover to your tax advisor. The centralised availability of documents in our archive gives you greater transparency across the various departments. The fast, simple and legally compliant archiving of invoices ensures a continuous process without media disruptions.

This works by means of OCR. “OCR” is an abbreviation for “Optical Character Recognition” and means “optical character recognition”. When digitising invoices, OCR text recognition captures all the characters on the invoice. Rules and patterns are used to extract the invoice date, amount, VAT ID and other relevant properties from the characters. In conjunction with artificial intelligence and with the help of the master data, further data can be determined or checked for plausibility on the basis of these properties.

Invoices are received by e-mail or on paper.

In the case of e-mail invoices, these are received automatically via an e-mail function mailbox.

Paper invoices, on the other hand, can be received via the d.velop cloud-based scanning software, for example, and then forwarded to SharePoint.

Once in SharePoint, the invoice is automatically analysed and classified in the background.

Furthermore, a release workflow is started, which automatically informs the relevant employees about new tasks.

The financial accounting department has control over the process. Financial accounting employees can see exactly which invoice is in circulation with which employee.

The paper invoices can be destroyed if the digital process is categorised as GoBD-compliant. This is generally to be expected with our system, but must be confirmed again by an auditor. For this purpose, a procedural instruction must be created that contains technical documentation and further explanations of the invoice processing procedure, which serves as the basis for the auditor’s assessment.

Our application has received a software certificate in accordance with IDW PS880. This confirms that, when used correctly, documents can be stored online in an audit-proof manner. Further information on the subject of security can be found on our website. You can decide which documents or folders you want to archive in an audit-proof and therefore GoBD-compliant manner.

Software Demo

Would you like to learn more about the Sharepoint digital invoice process?

Request a free demo of d.velop software.