Bedrijven en organisaties vertrouwen met succes op d.velop-facturen.

Kenmerken van digitale factuurverwerking

Ontdek de mogelijkheden van digitale factuurverwerking met

Het handmatig verwerken van inkomende facturen kost bedrijven dagelijks kostbare tijd en leidt tot onnodige kosten. Met de gedeeltelijke invoering van verplichte e-facturering op 1 januari 2025 neemt de druk om actie te ondernemen toe: wie nu niet digitaliseert, riskeert niet alleen inefficiëntie, maar ook overtredingen van de regelgeving. Maak van deze gelegenheid gebruik om uw factuurbeheer toekomstbestendig te maken. Vereenvoudig en automatiseer uw workflow voor factuurverwerking:

Factuurontvangst: Importeren via flexibele invoerkanalen

Papieren documenten worden gescand, gedigitaliseerd als PDF-bestanden en geïmporteerd. Als een factuur in digitale vorm via e-mail wordt ontvangen – bijvoorbeeld als XRechnung of in het ZUGFeRD-formaat – wordt deze automatisch en zonder enige handmatige inspanning in de software overgebracht.

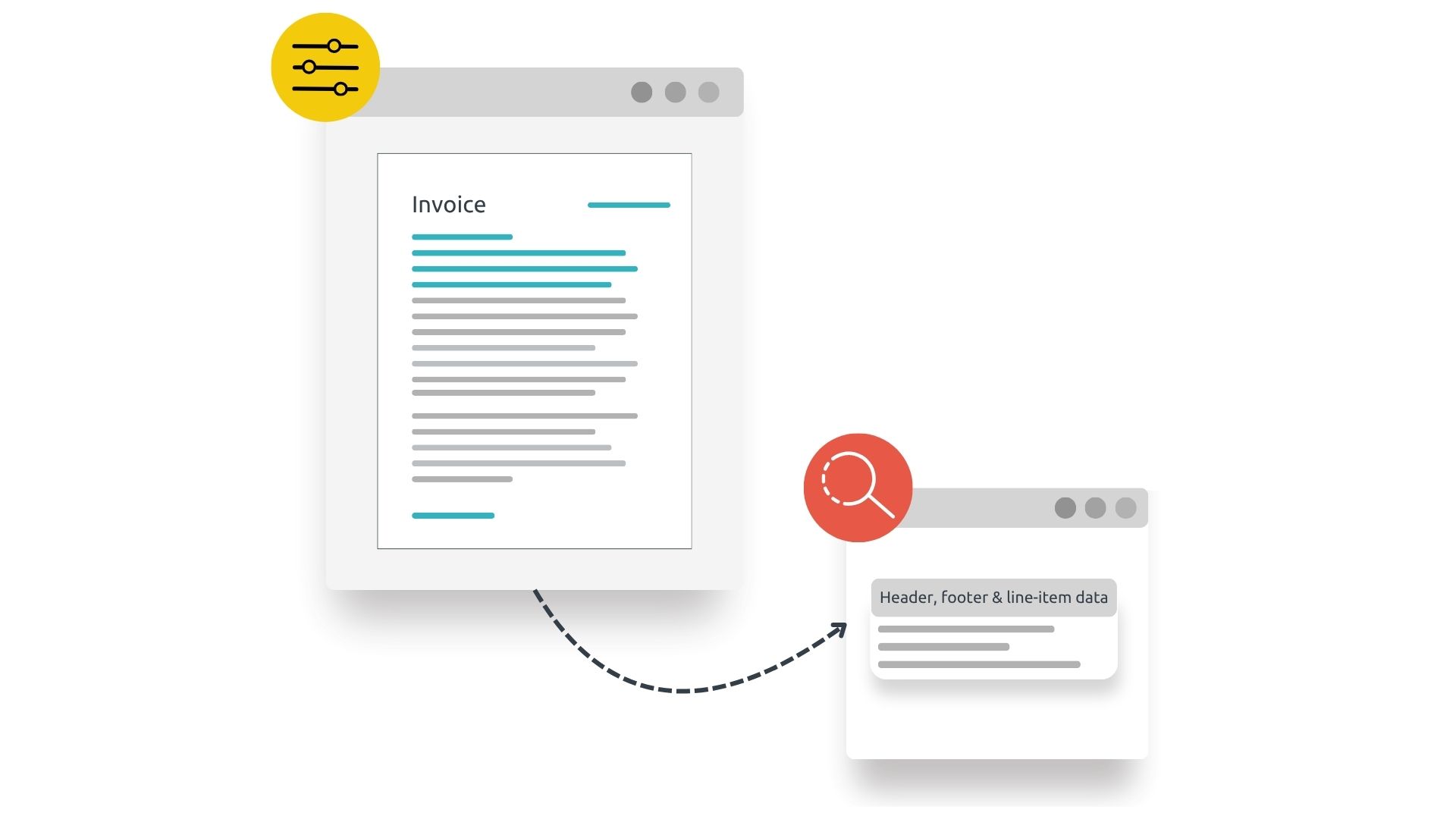

Factuurherkenning: gegevens lezen en extraheren

Alle relevante informatie, zoals koptekst, voettekst en regelitems, wordt automatisch uit de factuur gelezen en is altijd en overal beschikbaar. Handmatig typen en gegevens invoeren behoren daarmee tot het verleden.

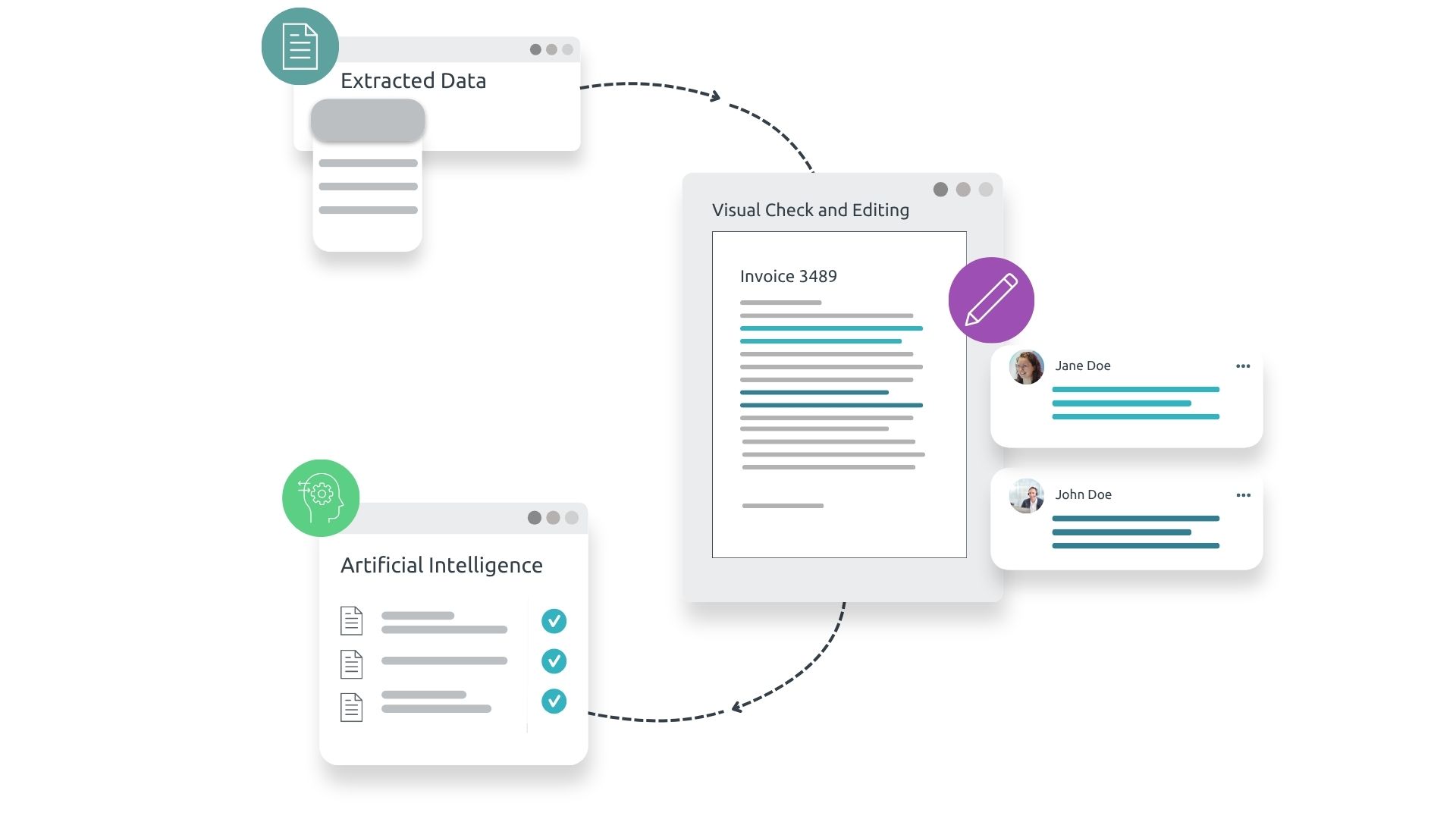

Gegevensverificatie: visuele controle ondersteund door AI

Na herkenning kunnen de geëxtraheerde gegevens worden bekeken en indien nodig worden bewerkt. Gebruikers worden ondersteund door kunstmatige intelligentie (AI), die continu zelfstandig leert op basis van hun invoer. Hierdoor wordt de software in de loop van de tijd steeds intelligenter, waardoor de herkenningspercentages gestaag verbeteren.

Factuur Witboek

Digitale factuurverwerking – tips en valkuilen bij de projectplanning

Is digitale verwerking van AP-facturen alleen interessant voor grote bedrijven? Wat als AP-factuurverwerking goedkoper zou zijn dan velen denken en de implementatie van een oplossing veel eenvoudiger dan verwacht? Waarom zou u niet beginnen met het digitaal verwerken van uw AP-facturen?

Dit witboek legt uit welke voordelen u kunt behalen, welke obstakels u mogelijk tegenkomt en beschrijft de noodzakelijke randvoorwaarden die u moet creëren.

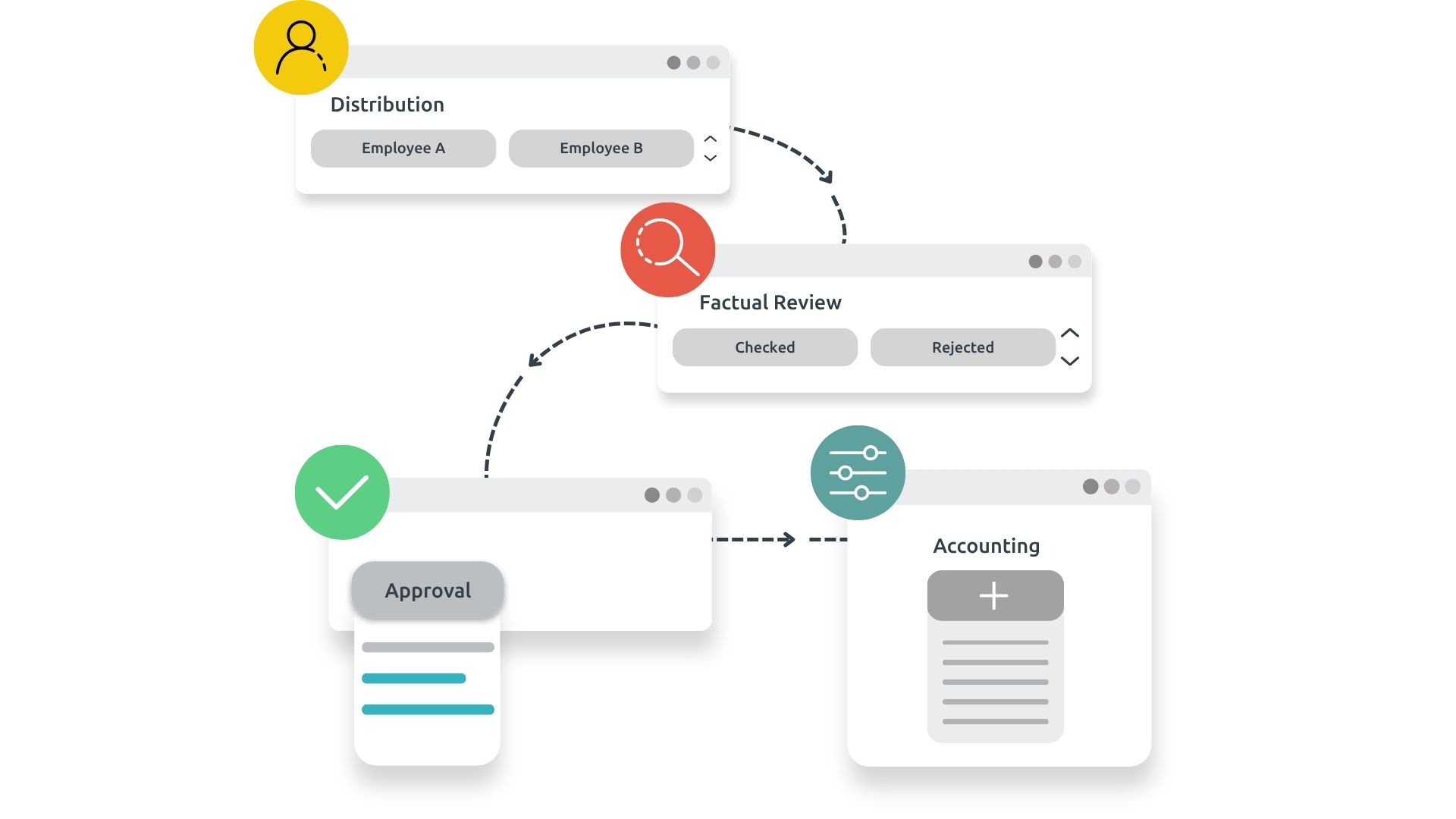

Factuurworkflow: controleren, goedkeuren en boeken

Zowel de digitale goedkeuringsworkflow als de voorwaarden voor de afzonderlijke (beoordelings)stappen kunnen worden aangepast aan uw behoeften. Ontwerp goedkeuringsprocessen volgens uw regels. Dankzij een automatische 3-weg-matching zijn arbeidsintensieve handmatige afstemmingen niet meer nodig en met het overzichtelijke beheer van vervaldata en het kortingsverkeerslicht hebt u altijd alle kortingsdeadlines in beeld.

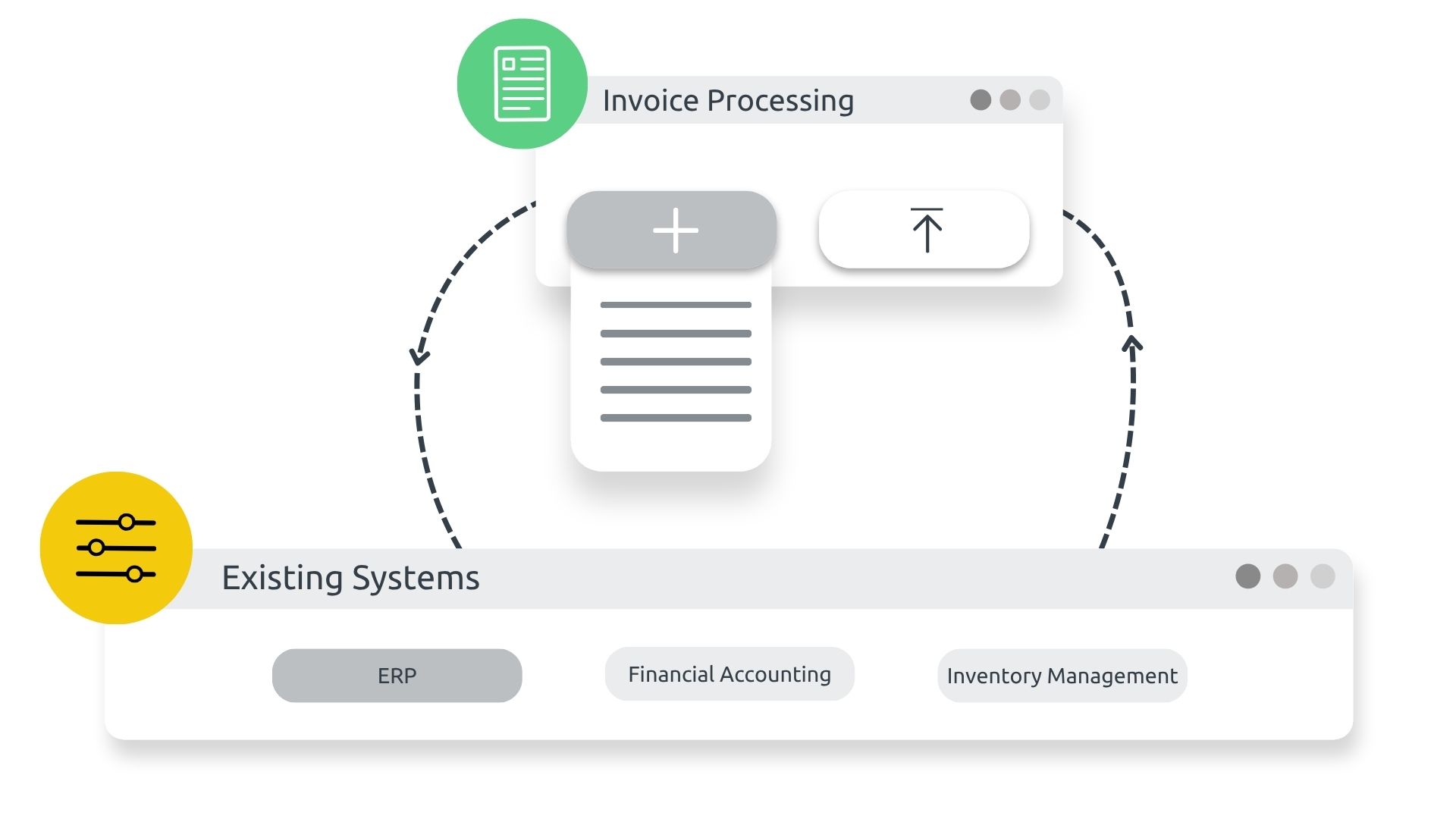

Interfaces: Naadloze integratie met bestaande systemen

Digitale factuurverwerking kan naadloos worden geïntegreerd in uw bestaande systemen (ERP, financiële boekhouding en voorraadbeheer) en is rechtstreeks gekoppeld aan uw inkoopprocessen en boekhoudkundige workflows.

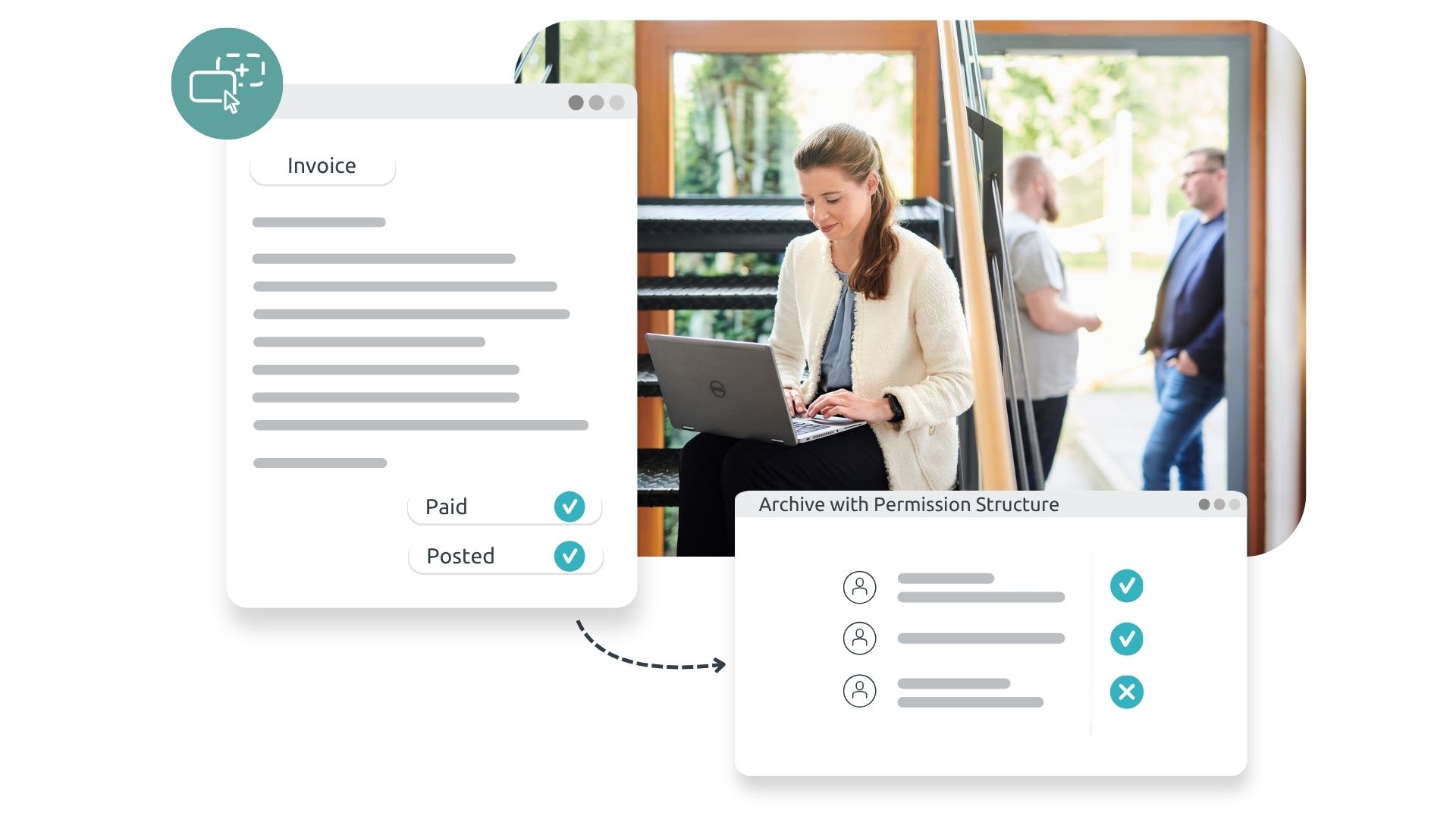

Auditbestendige archivering: houd alle facturen in het zicht

Verzonden facturen worden opgeslagen in een auditbestendig digitaal archief en zijn altijd en overal toegankelijk. De toegang wordt geregeld via individuele toestemmingsstructuren.

Integraties voor digitale factuurverwerking

Integreer digitale factuurverwerking naadloos in uw toonaangevende systemen.

De digitale factuurverwerking van d.velop is rechtstreeks gekoppeld aan uw boekhoudsystemen en volledig geïntegreerd in uw inkoopprocessen en boekhoudkundige workflows. Dit zorgt voor een eenvoudige, snelle en transparante afhandeling van alle factuurprocessen: van feitelijke factuurcontrole tot goedkeuring en definitieve boeking.

Als u SAP, Microsoft Dynamics of Microsoft SharePoint gebruikt, biedt d.velop de ideale oplossing voor het verwerken van uw facturen. Het kan ook worden geïntegreerd met andere ERP-systemen, waardoor een naadloze aansluiting op uw boekhoud- en inkoopworkflows wordt gegarandeerd.

Prijzen voor digitale factuurverwerking

d.velop factureert cloud-prijsmodellen

30 dagen gratis

0 € voor 30 dagen

- Alle functies

- Geen risico

- Eenvoudige onboarding

- Geen annulering vereist tijdens proefperiode

d.velop factureert kleine bedragen

340 € per maand plus btw

- 250 facturen/maand

- 5 boekhoudgebruikers

- Onbeperkt aantal goedkeuringsgebruikers

- Auditbestendige archivering

- Automatische extractie van factuurgegevens

- Zelfservice onboarding en e-learning inbegrepen

d.velop factureert gemiddeld

680 € per maand plus btw

- 750 facturen/maand

- 10 boekhoudgebruikers

- Onbeperkt aantal goedkeuringsgebruikers

- Auditbestendige archivering

- Automatische extractie van factuurgegevens

- Zelfservice onboarding en e-learning inbegrepen

d.velop factureert gemiddeld

680 € per maand plus btw

- 750 facturen/maand

- 10 boekhoudgebruikers

- Onbeperkt aantal goedkeuringsgebruikers

- Auditbestendige archivering

- Automatische extractie van factuurgegevens

- Zelfservice onboarding en e-learning inbegrepen

d.velop factureert grote bedragen

1.145 € per maand plus btw

- 1.500 facturen/maand

- 20 boekhoudgebruikers

- Onbeperkt aantal goedkeuringsgebruikers

- Auditbestendige archivering

- Automatische extractie van factuurgegevens

- Zelfservice onboarding en e-learning inbegrepen

d.velop factureert ondernemingen

2.065 € per maand plus btw

- 3.000 facturen/maand

- Inclusief 30 boekhoudgebruikers

- Onbeperkt aantal goedkeuringsgebruikers

- Auditbestendige archivering

- Automatische extractie van factuurgegevens

- Zelfservice onboarding en e-learning inbegrepen

Heeft u vragen?

Weet u niet zeker welk prijspakket het beste bij uw bedrijf of organisatie past? Of heeft u meer gedetailleerde vragen? Geen probleem! Wij geven u graag persoonlijk en op maat gemaakt advies.

Vul het formulier in en beschrijf kort uw vraag — wij nemen zo snel mogelijk contact met u op.

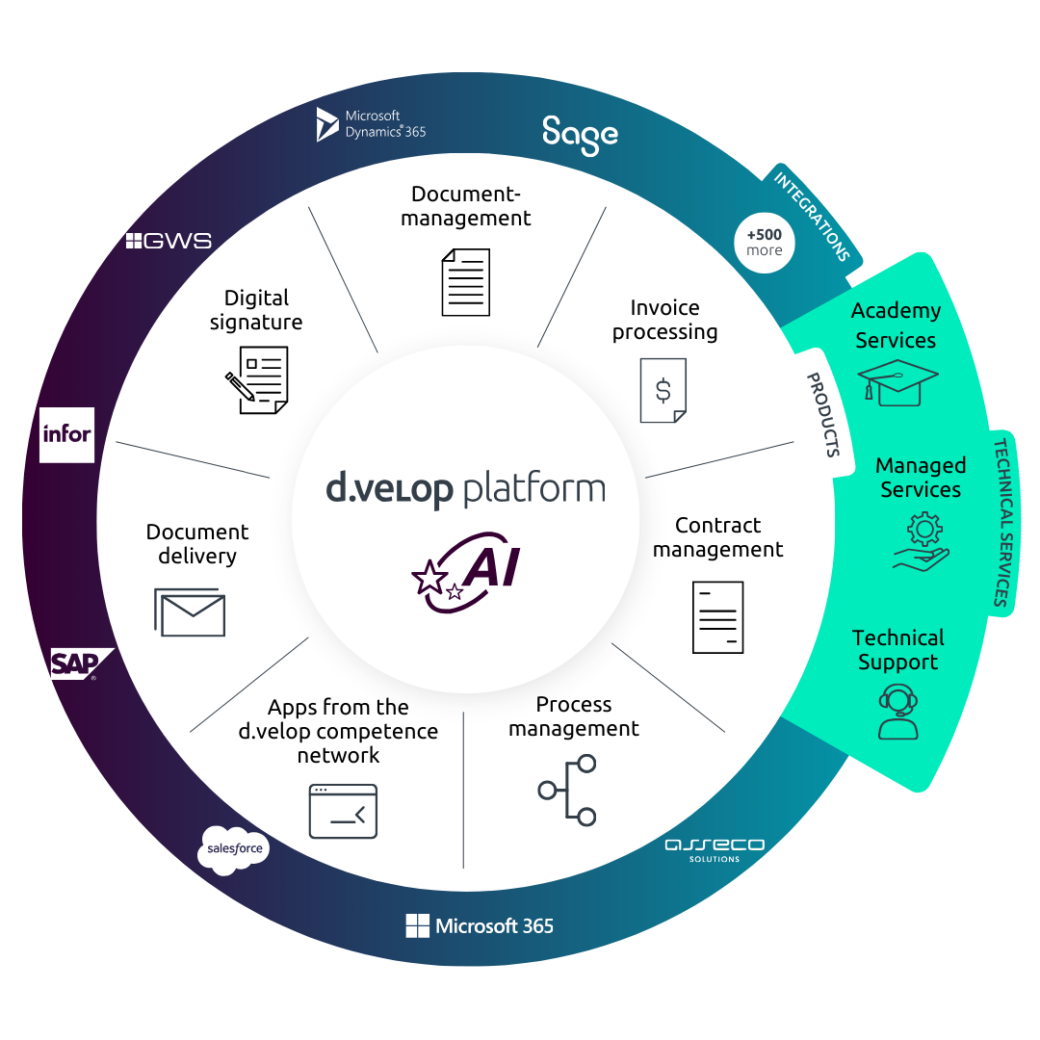

d.velop-platform

Benut het volledige potentieel van d.velop.

DMS, ECM, EIM of simpelweg: verbonden kennis

Productief, intelligent, veilig: uw d.velop-tools.

Digitaliseren, structureren, opslaan en informatie toegankelijk maken: onze d.velop-platformoplossingen zijn altijd afgestemd op uw behoeften en bieden naadloos toegang tot kennis – of het nu voor medewerkers, klanten of partners is. Dit verlaagt niet alleen de proceskosten en bespaart tijd, maar ontlast ook uw team en creëert ruimte voor innovatieve ideeën.

Nieuws & Bronnen

Focus op factuurbeheer

Wilt u meer weten over het gebruik van digitale factuurverwerking? Hier vindt u nieuws en uitgebreide informatie.

Veelgestelde vragen

Veelgestelde vragen over digitale factuurverwerking

Met digitale en geautomatiseerde factuurverwerking bespaart u zowel tijd als geld. Snellere verwerking verlaagt de transactiekosten, terwijl locatieonafhankelijke factuurverificatie de workflows versnelt. U kunt ook de overdracht van processen aan uw accountant volledig digitaliseren. Gecentraliseerde toegang tot documenten in ons archief vergroot de transparantie tussen afdelingen. Snelle, eenvoudige en wettelijk conforme factuurarchivering zorgt voor een naadloos proces zonder mediaonderbrekingen.

Facturen komen via verschillende inputkanalen bij een bedrijf binnen. Als ze nog niet in digitale vorm zijn, worden ze eerst gedigitaliseerd. Daarna volgt de gegevensextractie, oftewel de feitelijke factuurherkenning. De factuurgegevens worden gelezen en gekoppeld aan uw (leveranciers)stamgegevens. Vervolgens komt de digitale controle- en goedkeuringsworkflow, gevolgd door de overdracht naar de financiële boekhouding of het ERP-systeem, waar de factuur uiteindelijk wordt geboekt. Daarnaast wordt de factuur opgeslagen in een controleerbaar archief.

We bieden doorgaans een standaard goedkeuringsworkflow aan die bestaat uit distributie, feitelijke controle, goedkeuring en boekhouding. Zowel de workflow, inclusief de volgorde van de stappen, als de voorwaarden waaronder een factuur naar de volgende controlestap gaat, kunnen worden aangepast. Ook goedkeuringslimieten kunnen individueel worden afgestemd. Er kunnen meerdere goedkeuringsstappen met specifieke limieten worden aangemaakt, of er kan een matrix worden opgezet voor het automatisch toewijzen van verantwoordelijke controleurs.

Voor PDF-facturen gebeurt dit met behulp van OCR, wat staat voor 'Optical Character Recognition' (optische tekenherkenning). OCR legt tijdens het digitaliseren alle tekens op de factuur vast. Aan de hand van regels en patronen haalt het belangrijke informatie uit de factuur, zoals de factuurdatum, het bedrag, het btw-nummer en andere relevante gegevens. In combinatie met kunstmatige intelligentie en door gebruik te maken van masterdata kunnen op basis van deze geëxtraheerde gegevens aanvullende gegevens worden afgeleid of gevalideerd. Bij elektronische factuurformaten zijn alle gegevens onmiddellijk machinaal leesbaar en kunnen ze direct worden overgebracht naar de volgende verwerkingsworkflow.

Standaard ondersteunt de software-interface Duits, Engels, Portugees, Frans, Chinees, Deens, Italiaans, Kroatisch, Nederlands, Pools, Servisch, Slowaaks, Spaans en Tsjechisch. Voor factuurherkenning zijn veel extra talen beschikbaar. Bovendien kunnen projectspecifieke uitbreidingen worden geïmplementeerd.

Papieren facturen kunnen worden vernietigd als het digitale proces als GoBD-conform wordt aangemerkt. Dit wordt over het algemeen verwacht met ons systeem, maar moet worden bevestigd door een auditor. Er moet een procedurele instructie worden opgesteld, inclusief technische documentatie en verdere uitleg over de workflow voor factuurverwerking, die als basis dienen voor de beoordeling door de auditor. Onze applicatie heeft een softwarecertificering volgens IDW PS880 ontvangen, wat bevestigt dat documenten bij correct gebruik op een auditbestendige manier online kunnen worden opgeslagen. Ga voor meer informatie over beveiliging naar onze website. U kunt zelf bepalen welke documenten of mappen u op een wettelijk conforme, GoBD-conforme manier wilt archiveren.

Het digitaliseren van facturen biedt verschillende voordelen: het vereenvoudigt het archiveren en snel toegankelijk maken van documenten, vermindert het papierverbruik en verhoogt de efficiëntie bij het beheren van uw financiën. Bovendien verbetert het de gegevensbeveiliging door middel van back-upopties en maakt het het gemakkelijker om te voldoen aan wettelijke bewaarplichten door middel van georganiseerde opslag.

Contact & Advies

Wij verbinden data en mensen – en kijken ernaar uit om van u te horen.

Nieuwsgierig geworden? We laten u graag onze software zien.

Vraag eenvoudig een live demo aan.