Accounting Ensures Legally Compliant Business Operations

The world of accounting is shaped by a multitude of figures, formulas, and regulations that are indispensable for companies and organisations. Accounting is a cornerstone of every successful business. Why? Because it ensures that a company operates in a legally compliant manner and adheres to statutory regulations. More than that, it lays the foundation for further growth and new investments by providing management with figures that serve as a sound basis for strategic decision-making.

Financial Accountants Enable Business Growth

Financial accounting (also known as financial bookkeeping or simply: Fibu) plays a central role as a subfield of accounting. It records and processes all business transactions, including a company’s income and expenditure. Financial accountants are able to monitor a company’s liquidity and present its financial situation through balance sheets. With the right tools, financial accounting becomes a source of strength and growth.

Accounts Payable and Receivable Safeguard Liquidity

Key pillars within financial accounting are accounts payable and accounts receivable. While accounts payable deals with managing liabilities to suppliers and service providers, accounts receivable focuses on managing receivables from customers. Both aspects serve to monitor cash flow and ensure the company’s liquidity.

Outdated Technologies Hinder Efficient Accounting Work

Despite its immense importance, accounting and financial accounting face significant challenges in many companies and organisations when it comes to performing tasks in a modern way. Especially in non-digital environments, time-consuming activities consume valuable human and financial resources. Outdated technologies hinder smooth collaboration and complicate the consolidation of data for financial reporting. In many cases, incomplete records go hand in hand with a lack of digitalisation—particularly when documents are stored in physical folders. In extreme cases, missing control mechanisms can even facilitate fraud and corruption.

Transparency and Efficiency Through Digital Technologies

Affected companies could overcome these obstacles by implementing digital technologies: an IT infrastructure with suitable accounting software would be the solution. However, companies wishing to digitise their bookkeeping must initiate an internal digital transformation and establish a digital mindset. Moving away from analogue workflows towards smart processes. Support from an experienced digitalisation expert can be invaluable here, offering advice based on numerous projects and assisting with implementation. Most importantly, companies must first recognise that a problem exists—only then can it be resolved.

white paper

Digital invoice processing — 9 arguments for your IT department

Anyone who says it’s hard to get colleagues excited about digital processing of accounts payable probably just needs the right arguments. The advantages of accounts payable processing for users and companies are obvious.

The white paper will help you to dispel reservations. Win over even the skeptics and doubters for the introduction of a digital accounts payable processing system.

- 15 % additional costs incur in companies on average due to maverick buying.

- 75 € are the average process costs per purchase order.

- 87 % of procurement leaders believe that digitalisation will improve procurement.

Definition: What Is Accounting?

The term accounting refers to the process of recording and monitoring all business transactions that occur within a company. It is one of the most important functions in business operations and ensures that all financial activities of a company are accurately documented and tracked.

Definition: What Is Financial Accounting?

Financial accounting provides a comprehensive overview of a company’s financial health and enables decision-makers to develop strategies and make informed decisions based on reliable data.

Digital Accounting with Centralised Data Access

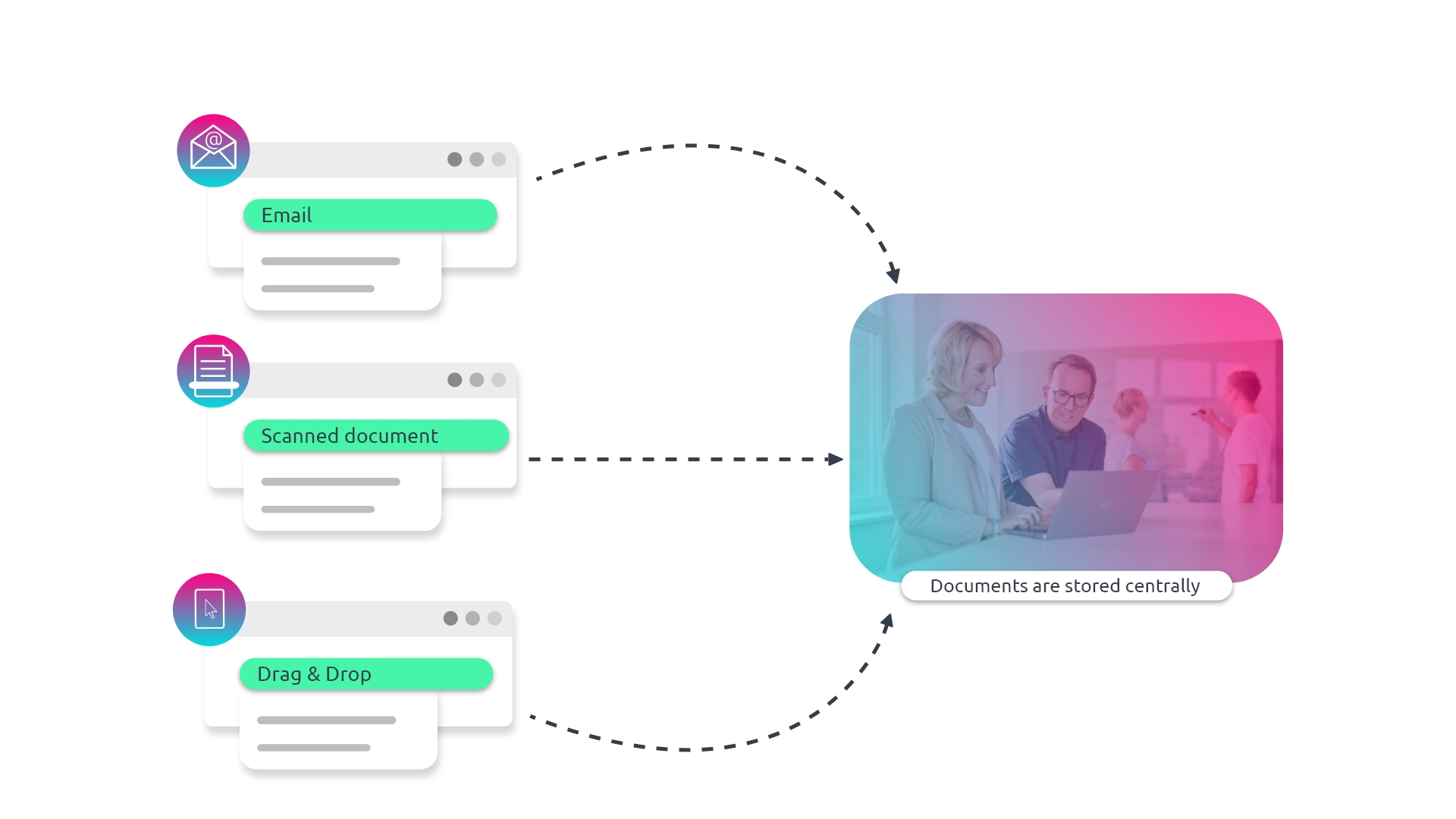

Professional digital accounting is key to successful business operations and helps promote a company’s financial stability and growth. The foundation for this is an IT infrastructure with compatible software systems that allow for centralised, seamless exchange of data and files.

Document Management System (DMS) as a Central Archive

The solution is a Document Management System (DMS) serving as a central document archive, into which specialised software such as DATEV, Lexware, Sage 50, SAP Business One, or Microsoft Dynamics Business Central can be integrated. This enables immediate access to the database by all employees and centralised data analysis by the financial accounting department. Digital document archiving also ensures audit compliance, as required by law for the storage of digital tax-relevant documents.

DMS White paper

Digital Document Management Easy Explained

What should a document management system be capable of? What are the benefits of implementing one? And what does AI in document management actually look like? This 35-page whitepaper is packed with expert knowledge – including practical tips, fillable checklists, answer fields, and a downloadable short presentation to help you convince your team of the value of a DMS.

Contents of the Whitepaper:

- A clear introduction to digital document management

- Overview of the seven key functionalities of a DMS

- Special focus: Artificial Intelligence in document management

- Step-by-step guidance for successful DMS implementation

- Advanced topics: Process digitalisation and invoice handling

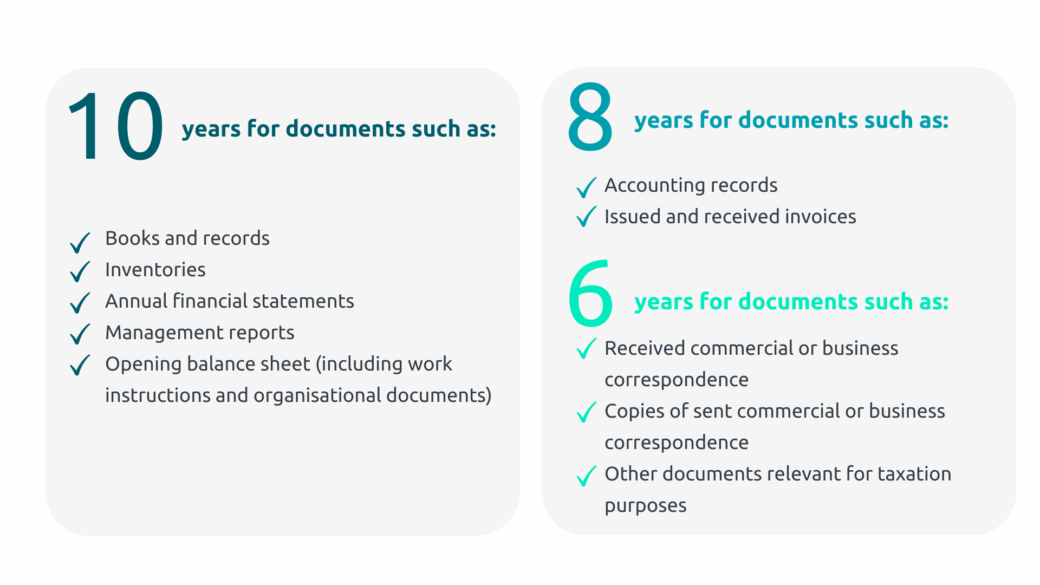

What Are the Retention Periods in Accounting?

Retention periods play a crucial role in accounting. They determine how long certain records and documents must be kept to comply with legal requirements and to serve as evidence in the event of audits or legal disputes. The following is an overview of the standard retention periods in accounting:

Retention periods may vary depending on country regulations.

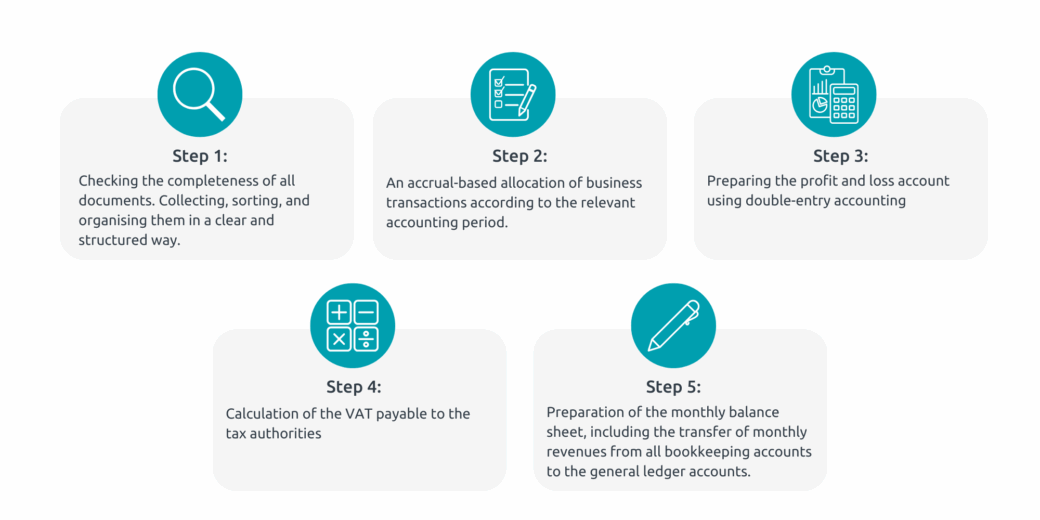

What Are the Main Tasks of Accounting?

Accounting—particularly financial accounting—ensures clarity and transparency in all financial matters. Its core responsibilities are diverse and go far beyond simply maintaining cash books or preparing annual financial statements. A closer look at the various aspects of accounting and financial accounting reveals their significant contribution to a company’s success.

- Recording and posting all business transactions within the company

- Creating accounting documents such as invoices and payment receipts

- Managing accounts and accounting records

- Preparing monthly and annual financial statements

- Monitoring cash flow, receivables, and payables

- Submitting VAT returns and other tax declarations

- Analysing accounting data and preparing financial reports such as profit and loss accounts and balance sheets

- Collaborating with tax advisors and auditors

- Ensuring compliance with legal regulations and retention requirements

- Executing payment runs and managing dunning procedures

What Accounting Methods Are There?

Accounting methods refer to the techniques and procedures that companies use to record, classify, and analyse their financial transactions. The choice of method depends on factors such as the size of the company, the industry, and legal requirements. An effective accounting method is essential for accurately representing a company’s financial performance. The main methods include:

What Types of Accounting Systems Are There?

Accounting systems are the core of every company’s finance department. They enable the precise recording of income and expenses, allowing management to make informed strategic decisions based on reliable data. There are several types of accounting systems, each with its own strengths and weaknesses.

Manual Accounting

Manual accounting is the oldest form of bookkeeping and is still used by smaller businesses and sole traders. In this system, all transactions are recorded on paper-based ledgers and spreadsheets, and stored in physical folders. Manual bookkeeping is inflexible, as documents are only available in physical form and are difficult to integrate into digital workflows. This leads to media discontinuities, high storage costs, long processing times, incomplete records, and high resource consumption.

Excel-Based Accounting

Many small businesses use Excel spreadsheets to manage their finances. Excel offers a simple way to track income and expenses and perform automatic calculations. However, Excel-based accounting is prone to errors due to manual data entry. It also prevents workflow automation and lacks proper data security. Collaboration is difficult when multiple people work on the same file, and compliance issues may arise if data protection and traceability are not ensured.

Accounting Software

The most commonly used method today is dedicated accounting software. There are many providers offering locally installed programmes that help businesses generate financial reports, issue invoices, and manage payments. However, access to data is limited, collaboration is restricted, data backups are challenging, and scalability is low. A far more modern and efficient alternative is cloud-based accounting software.

Cloud-Based Accounting Software

Cloud-based accounting software allows employees to access financial data anytime, anywhere. These systems are the most flexible, meeting the needs of users who want to work remotely and collaboratively. They require no on-premises hardware or software installation, are infinitely scalable, enable global collaboration, and open the door to automated processes. Additionally, they offer higher data security, as information is stored in secure data centres.

ERP Systems

ERP systems (Enterprise Resource Planning) are comprehensive platforms that integrate various business processes such as accounting, inventory management, production, and HR. These systems are ideal for larger companies managing complex operations. The accounting module within an ERP system automates many tasks, including invoice processing, bank transactions, accounts payable and receivable, and financial reporting. This saves time and reduces the risk of errors.

White paper

Digital invoice processing — tips and pitfalls in project planning

What if AP invoice processing were cheaper than many think and implementing a solution far easier than expected? Why not get started with processing your AP invoices digitally?

This white paper explains the advantages you gain, the possible obstacles you may face and describes the necessary framework conditions you need to have in place.

Choosing the Right Accounting System

Selecting the right accounting system is crucial for any business, regardless of its size or industry. There is a wide range of accounting systems available—from simple spreadsheet programmes to complex software packages. Making the right choice requires careful consideration and a thorough understanding of the company’s needs. One thing is clear from the outset: analogue systems, meaning those based on paper, will not lead any business to success. They consume too much time, space, and resources, are inflexible, and no longer meet the expectations of many clients when it comes to data exchange.

Cloud-Based Accounting Software?

The first step in finding a provider for a digital accounting system is to analyse the company’s requirements and document them in detail. These might include automating recurring processes such as invoice creation, posting incoming invoices, and processing payments. A well-defined list of requirements helps compare different providers and is readily available when needed. Before making a decision, it is essential for those responsible to familiarise themselves with the different types of accounting systems, such as cloud-based or hybrid solutions. Only then can they assess the future potential of each option. And not least, it is important to set a budget.

An Experienced Digitalisation Partner Can Help

After thorough research—including reading online user reviews—a system can be selected that meets the company’s specific needs and fits within the budget. An experienced digitalisation partner, such as d.velop, can help identify the right tools and implement the planned workflows digitally. A comprehensive testing phase before final purchase is essential to ensure the product is user-friendly and fully meets the requirements. This also includes ensuring that the accounting system is compatible with other systems in use. It should be easily adaptable and able to grow with the business — i.e. it must be scalable.

What Are the Core Issues in Financial Accounting?

Financial accounting faces a range of challenges that are common even in companies with well-trained staff and meticulous processes. Addressing these issues is essential for businesses of all sizes, as accurate financial accounting forms the foundation for successful operations. Here are some of the most frequent problems that nearly every company would like to eliminate:

- Incorrect Data Entry: Manual data entry errors can lead to incorrect postings, inaccuracies in the chart of accounts, and ultimately a misrepresentation of the company’s financial position.

- Non-Compliance with Accounting Standards: Companies must ensure that their financial accounting complies with applicable accounting standards. Only then can they produce accurate financial reports that are understandable to stakeholders. Incorrect or misleading financial information undermines investor confidence and can lead to legal consequences.

- Insufficient Documentation: Poor or incomplete record-keeping can result in inaccurate financial reporting and difficulties during audits or tax filings. This may lead to poor decision-making or non-compliance with legal obligations such as submitting tax returns.

- Issues with Expense Tracking: All business expenses must be properly recorded to ensure a clear financial overview and to enable accurate preparation of annual accounts and tax declarations.

- Inconsistent Accounting Methods: Using inconsistent accounting methods can result in irregular financial reports, making it difficult to track a company’s financial performance over time.

- Fraud and Misuse: Fraud and misuse occur when employees or third parties exploit the system to steal or embezzle funds. Such incidents can severely damage a company’s reputation and, in extreme cases, threaten its existence.

- Technological Challenges: Companies must ensure that their IT systems and accounting software are up to date to maintain the accuracy and efficiency of their financial reporting.

What Are the Benefits of Digital Financial Accounting?

Calculators, piles of paper, and endless columns of numbers? Those days are over. In digital financial accounting, user-friendly software has taken their place—making life much easier for accountants. But what exactly makes digital financial accounting so great? Here are some compelling reasons to embrace digitalisation in finance:

Time Savings for More Strategic Tasks

By automating processes such as data entry and processing, the time required for manual bookkeeping can be significantly reduced. This allows accountants and finance teams to focus on strategic tasks and contribute to the growth of the business.

Simplified Collaboration and Greater Efficiency

With digital financial accounting, accountants and finance teams can access centrally stored financial data in the document management system (DMS) anytime and from anywhere, enabling them to work together on the same documents. This improves communication and collaboration within the team and increases overall efficiency.

Improved Data Quality Through Fewer Errors

By using automated processes and systems, digital financial accounting improves the accuracy and consistency of financial data. Manual entry errors and human mistakes can be significantly reduced, resulting in higher data quality.

Cost Savings Through Reduced Paper-Based Processes

Implementing digital financial accounting helps cut costs by reducing or eliminating manual and paper-based tasks. This also enables accountants and finance teams to work more efficiently and complete more tasks in less time.

Scalability of Cloud-Based Software

Cloud-based accounting systems support business growth by being scalable and adaptable to expansion. They eliminate the need for costly on-premises hardware upgrades and in-house IT maintenance. Additionally, they offer greater flexibility, global accessibility, and enhanced data security through secure data centres.

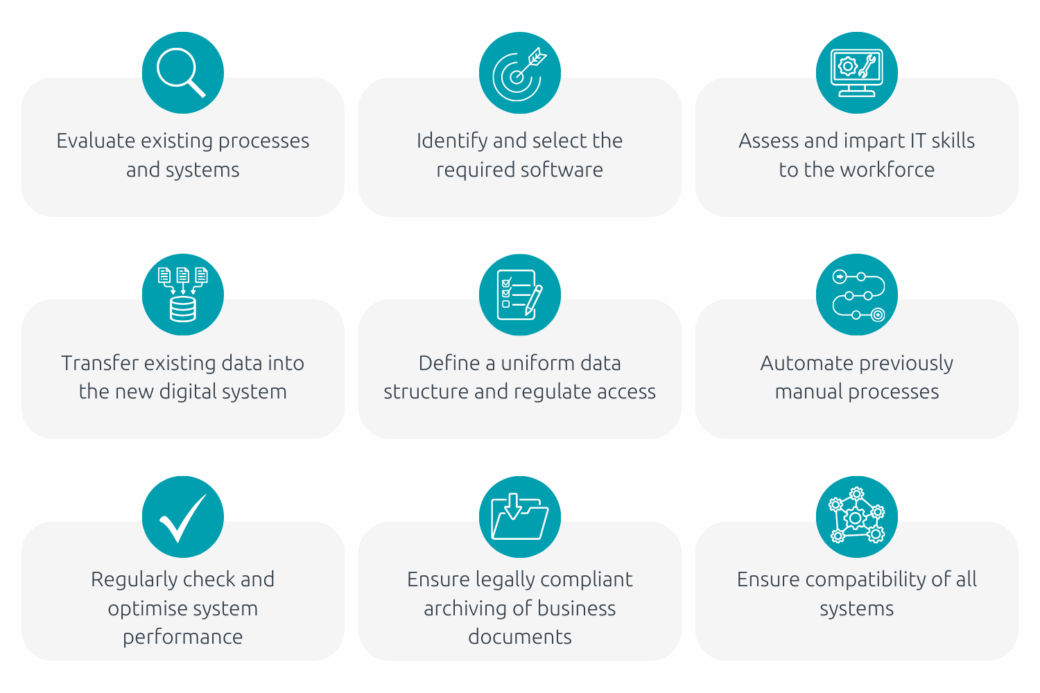

How to Digitise Your Financial Accounting in 9 Steps

Digitalisation has fundamentally transformed many areas of work in recent years—and financial accounting is no exception. It offers numerous advantages by relieving staff of repetitive tasks and performing many processes more accurately than any human ever could. Yet many companies are still unsure whether and how to approach digitalisation, and which steps are necessary to ensure a successful transition. This chapter outlines what needs to be done to successfully digitise your financial accounting:

- Evaluate your current financial accounting systems and processes to identify areas where digitalisation could be beneficial. For example, digital invoice processing can save a significant amount of time through automation, ease the workload of the accounting department, and enable digital archiving of receipts.

- Identify the software required for the digitalisation of your business processes that meets your needs, and choose a suitable solution.

- Establish a consistent structure for storing electronic documents and implement appropriate security measures to control access to sensitive information.

- Transfer all relevant data from the old systems to the new one (e.g. through replacement scanning). A thorough review and validation of the data is recommended.

- Ensure that your employees have the necessary skills to use the new software. Training may be required for this purpose.

- Reconsider your entire workflow and business process management, and automate as many processes as possible. This can improve efficiency and reduce errors. One example is automatic account assignment, which requires no human intervention.

- Regularly monitor the performance of your digital system and identify potential bottlenecks or areas for improvement to continuously optimise your system.

- Ensure compliance with all legal requirements related to the digital archiving of business documents.

- Make sure that all your systems are compatible with each other to ensure smooth data flow. If necessary, an experienced provider of your (financial) accounting software may offer interfaces to IT systems such as Sage, Lexware, Datev, Abacus or SAP.

And finally: Regularly monitor your accounting processes to ensure that your digital system is operating correctly and supporting your business operations effectively.

Overview of d.velop Products for Financial Accounting

d.velop documents for quick access to all documents

d.velop documents is the ideal solution for secure collaboration, offering centralised and fast access to your documents within a single system.

With d.velop documents, you can digitally store all documents relevant to (financial) accounting, such as invoices, receipts, and contracts. This ensures that all important documents are always readily available and can be accessed quickly and easily at any time.

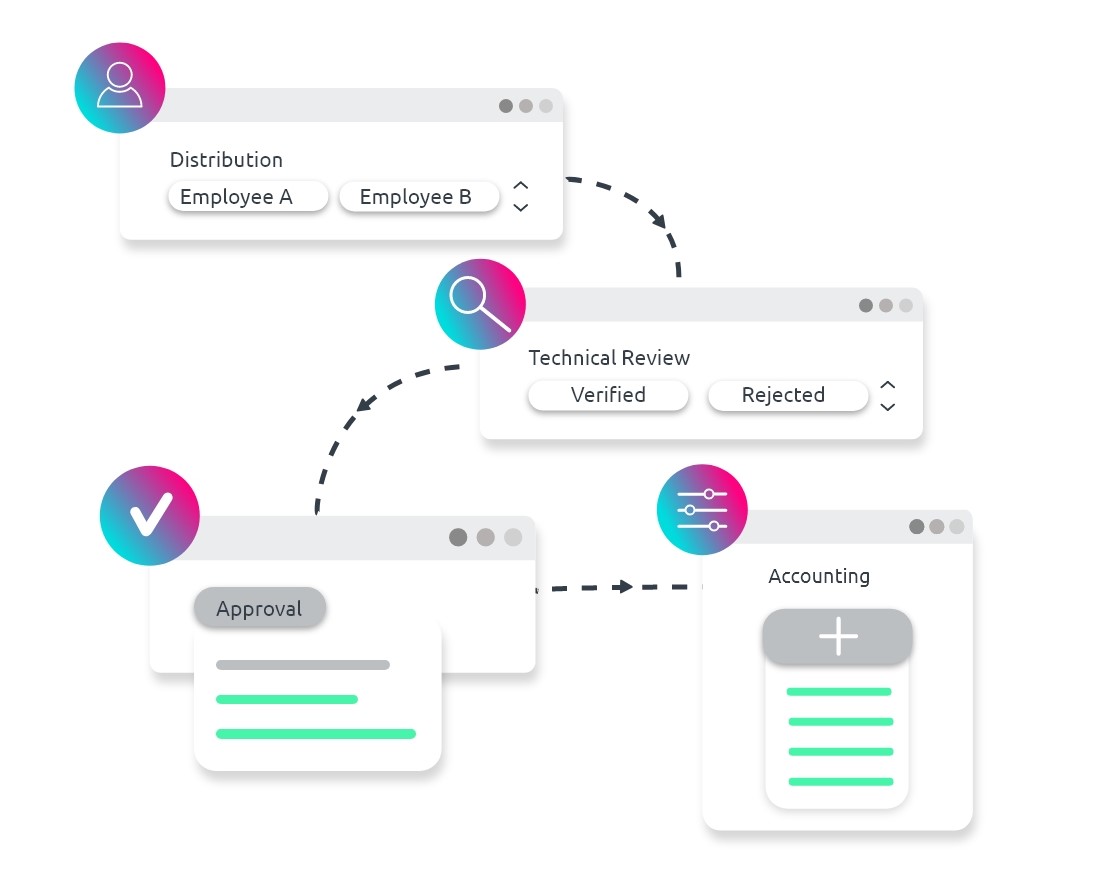

Automate the processing of incoming invoices

With d.velop invoices, you can accelerate, simplify, and optimise the processing of your incoming invoices. This enables seamless automation of invoice handling in no time at all. The software automatically recognises all relevant data on an invoice and transfers it directly into your financial system. The result: time saved, fewer errors, and increased transparency.

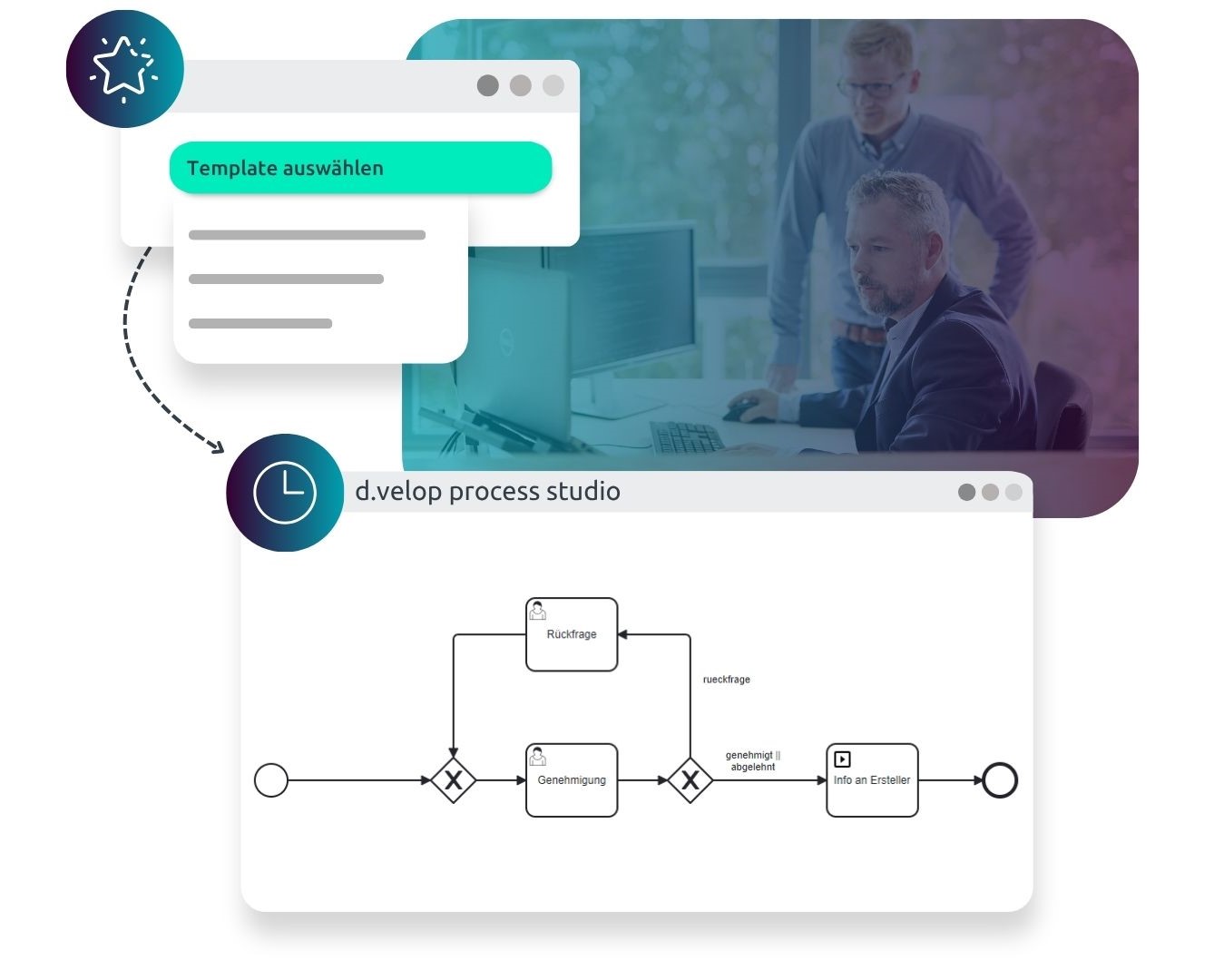

d.velop process studio automates routine tasks

With d.velop process studio, you can automate and optimise your accounting processes. For example, you can set up workflows to automate approval procedures and accelerate accounting operations. One typical use case: complying with data retention and deletion periods is a recurring routine task usually handled by the same employees. With process studio, you relieve your staff of time-consuming manual tasks and speed up the flow of information across your organisation.

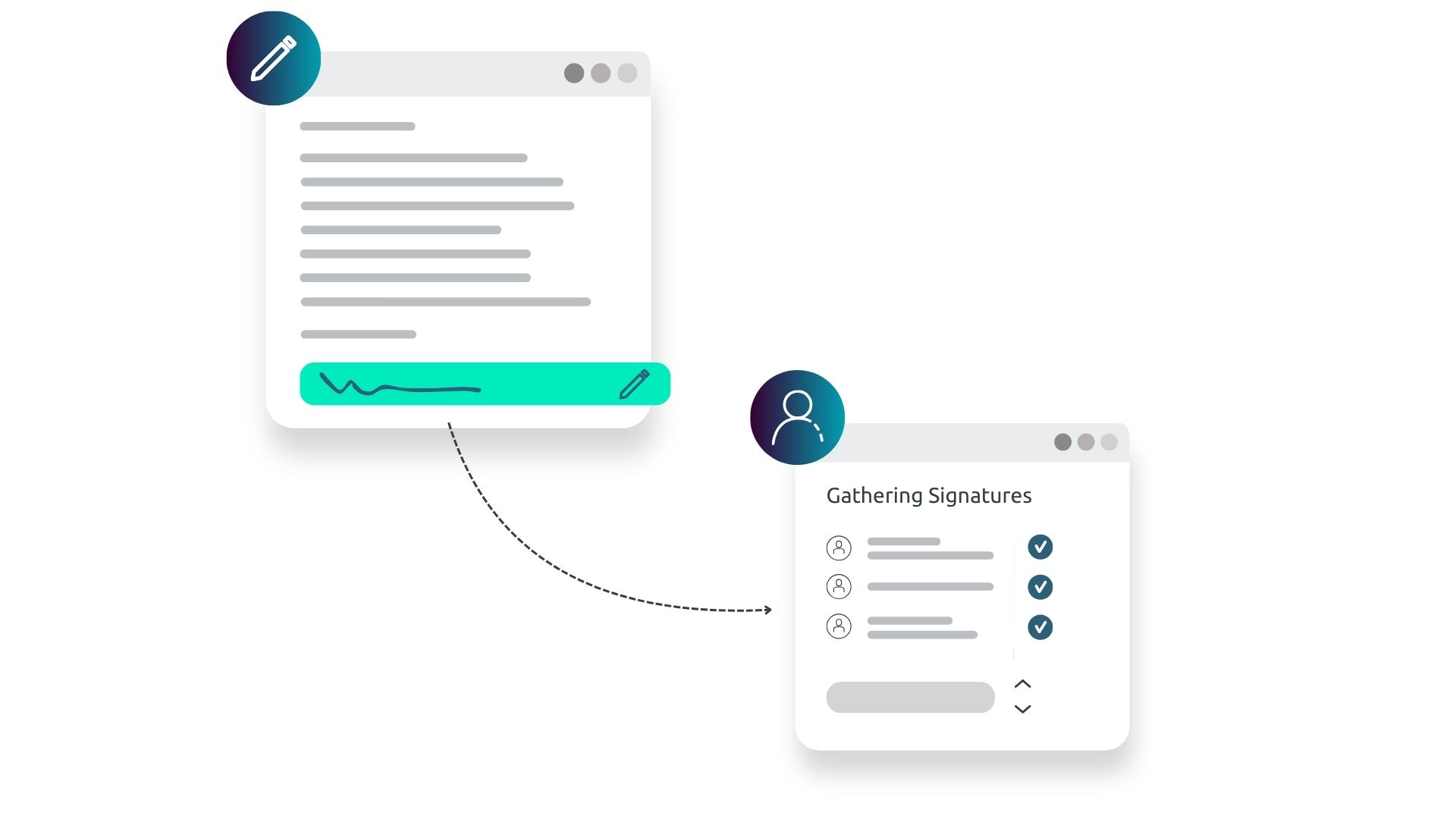

d.velop sign enables legally compliant digital signing

Save time, reduce process costs, and create flexibility – these are the key benefits of d.velop sign. d.velop sign is a digital signature solution that helps people across all departments fully digitise their signing processes. With d.velop sign, your accounting department, for example, can electronically and legally sign various types of documents – such as financial reports, tax returns, invoices, contracts, and payslips – all from anywhere, thanks to the cloud.

Conclusion: Digital Accounting Reduces Errors

Companies that rely on digital solutions in accounting benefit from improved data accuracy, greater transparency, and more efficient workflows. By using digital tools and automated processes, tasks are accelerated and costs are reduced. At the same time, the error rate decreases, as error-prone manual data entry becomes a thing of the past. Digital tools also enable faster and more effective analysis of financial data – leading to a better understanding of the company’s financial position and more informed strategic decision-making.

ACCOUNTING DIGITALISATION on the blog

Discover more about the digital finance department

On the d.velop blog, you’ll regularly find background articles, expert insights, and practical inspiration on the digital finance department, legal considerations, current market developments, and much more.

Frequently Asked Questions About Financial Accounting

Financial accounting refers to the systematic recording, monitoring, and evaluation of all financial transactions within a company or organisation. It serves to document and control finances and supports, for example, the preparation of annual financial statements and tax returns.

Financial accounting is essential for monitoring and managing a company’s financial status and for making informed business decisions. It also enables the creation of financial reports required for tax filings and disclosures to stakeholders such as investors.

Financial accounting involves the systematic recording and documentation of all financial transactions, as well as their monitoring and analysis. It forms the basis for preparing annual financial statements and other business evaluations.

Financial accounting software automates bookkeeping processes and makes it easier to organise and manage financial data. This reduces errors, saves time and costs, and provides better visibility into a company’s financial situation.

Contact & Consultation

We Connect Data and People – And Look Forward to Hearing from You.

Curious? We’d be happy to show you our software.

Simply request a live demo.