Uniting People, Process and Technology to strengthen control, compliance and confidence

In an era where financial integrity and compliance are under the spotlight, organisations face two mounting challenges: the rising cost of financial operations and the risk of Failure to Prevent Fraud (FTPF). Manual approvals, disconnected systems and unclear audit trails don’t just slow your business processes, they create the very vulnerabilities fraudsters exploit. d.velop’s Finance & Treasury Automation provides a modern answer: connecting people, processes and technology (PPT) into a single, transparent ecosystem. It doesn’t just make finance faster, it makes it fraud-resilient, compliant and auditable by design.

People: Building Awareness, Accountability and Assurance

Even the best systems fail without the right culture and ownership. That’s why d.velop places people at the centre of financial control.

- Segregation of duties made simple – d.velop workflows ensure that no single user can both create, approve and post the same invoice, removing key fraud risks.

- Clear approval hierarchies – Approval chains are pre-defined and role-based, ensuring that spend authorisation matches job responsibility and value thresholds.

- Transparency and accountability – Every user action from document upload to payment approval, is recorded with time and user ID stamps.

- Simplified user experience – Integration with major financial systems including: SAP, NetSuite and Microsoft D365, users continue to work in familiar environments, reducing errors and process bypass.

- Empowered teams – With automation handling repetitive tasks, finance professionals can focus on analysis, exception handling and customer success.

- Continuous training and awareness – Alerts, prompts and approval notes remind users of compliance obligations and ethical responsibilities.

By making responsibility visible, d.velop fosters a culture where accountability and fraud prevention are everyday practices, not occasional audits.

Research Report: Adapting to a digital-native world: Financial services document management beyond 2025.

Financial services institutions (FSIs) are under increasing pressure due to rising cyber threats, internal fraud, and the challenges of remote work. To assess the current state of digital document management in FSIs, d.velop and FStech surveyed industry leaders, revealing both progress in DMS adoption and significant challenges, including limited leadership support, security integration hurdles, and difficulties in incorporating innovations like AI.

Process: Embedding Control and Compliance into Every Workflow

The process layer is where d.velop truly hardens an organisation against fraud, digitising, connecting and monitoring every financial transaction.

Finance and Treasury Automation

- End-to-end invoice processing – From receipt to posting, invoices are automatically captured, classified and validated.

- AI-based OCR and data extraction – Captures key invoice fields and compares them to supplier master data, ensuring accuracy.

- Auto-suggest G/L accounts and cost centres – Reduces manual coding errors that can hide misallocations or manipulation.

- Duplicate invoice detection – Stops double posting or re-submission fraud before payment is released.

- Three-way matching – Validates invoices against POs and goods receipts, blocking unapproved or fraudulent claims.

- Digital approval workflows – Rule-based routing enforces proper authorisation chains and segregation of duties.

- Audit-proof archiving – All documents are stored tamper-proof, compliant with GDPR and European Accounting, Bookkeeping and Audit standards GoBD and IDW PS880.

- Automated exception routing – Any irregular transaction triggers an additional approval or investigation route.

- Systematic access controls – User permissions are enforced centrally to prevent unauthorised document access or edits.

- Real-time monitoring dashboards – Finance and Compliance gain instant insight into delayed, escalated tasks with oversight to all workflows.

- Workflow logs for audit readiness – Each invoice’s journey, from receipt to payment, is logged in full — providing second-by-second traceability for investigators or auditors.

- Vendor master data governance – Supplier details, such as bank accounts, cannot be changed without senior authorisation and dual control.

By redesigning these core financial processes, d.velop enables finance teams to achieve both efficiency and integrity, protecting the organisation from fraud risk while improving productivity.

Technology: Connecting Systems, Strengthening Security

Technology is the backbone of prevention and organisations should close technology gaps to ensure fraud is not the byproduct of shadow IT. d.velop’s secure, cloud-ready platform connects systems and enforces control without compromise.

- Deep SAP and NetSuite integration – Certified connectors ensure invoices, contracts and payments are stored and referenced securely.

- Microsoft D365 and Teams integration – Enables collaboration and approvals within existing tools, but under the same governance rules.

- AI-driven anomaly detection – Machine learning analyses historical data to flag unusual invoice values, duplicate vendor behaviour, or suspicious posting patterns.

- Compliance automation – Retention periods, audit trails and data protection obligations are handled automatically.

- Role-based access and encryption – Protects sensitive data and ensures only authorised users can access or approve financial documents.

- Secure external collaboration – Vendors and partners exchange documents through controlled, auditable channels, reducing exposure to phishing and impersonation fraud.

This integrated ecosystem not only enforces compliance but provides the forensic visibility required to detect and deter fraud proactively.

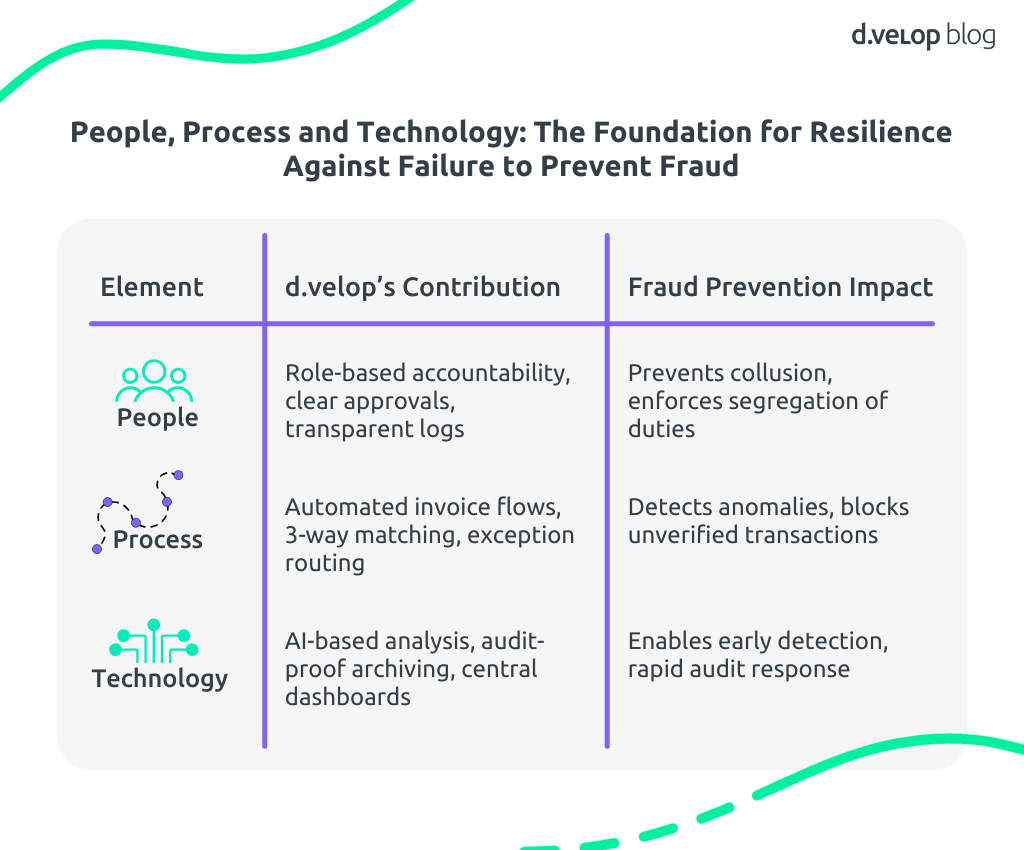

The Power of People, Process and Technology

Combining People, Process and Technology isn’t just a framework, it’s the foundation for resilience against Failure to Prevent Fraud.

When these three elements work together, organisations move from firefighting to foresight, positioned to prevent fraud rather than simply react to it.

From Control to Confidence

With d.velop’s platform for Finance & Treasury Automation, CFOs and Compliance Officers gain:

- Faster processing — up to 60% reduction in invoice cycle times.

- Cheaper operations — lower cost per invoice and early payment discounts secured.

- Safer processes — audit-proof archiving, role-based security, and AI-driven anomaly alerts.

- Compliant by design — full adherence to finance and data protection standards.

- Smarter oversight — real-time dashboards linking finance performance to fraud prevention metrics.

Finance automation isn’t just an efficiency project, it’s a strategic. With d.velop, businesses can prove they are taking “reasonable steps” to prevent fraud, meeting both regulatory expectations and corporate governance standards.