According to a recent Statista study, the world is heading toward a data explosion of 394 zettabytes by 2028. That’s the equivalent of 394 billion 1 TB laptops—or a single HD movie that would run for 2.5 billion years. With data volumes of this magnitude, it’s time we start archiving documents and files electronically and future-proof.

Yet, many companies still rely on paper-based processes, facing challenges like document loss, media disruptions, and space constraints. But digital archiving isn’t just about finding files faster—it’s also about meeting legal requirements such as GoBD-compliant and audit-proof storage. In this blog post, you’ll learn how to get started with digital archiving and which tools can support you along the way.

Document archiving is key to efficient work and secure information management. Systems like those from d.velop ensure structure, security, and legal compliance through intelligent encryption, verified backup strategies, and clear

Marwin Meller

filing structures.

Senior Product Marketing Manager, d.velop documents

Why Archiving Documents Matters

Archiving documents and files doesn’t just mean storing them somewhere digitally. It means keeping them in a systematic, traceable, and legally compliant way—so they remain accessible, unchanged, and verifiable when needed.

Unlike simple file storage, digital archiving involves structured processes, protection against tampering, and adherence to legal standards.

DMS Helps Companies Stay in Control

Whether it’s invoices, contracts, emails, internal reports, or scanned paper documents—all must be stored securely and permanently. Modern Document Management Systems (DMS) help businesses archive files without losing track, while ensuring compliance with legal and internal standards.

Legal Requirements & Retention Periods in Germany

Document archiving in Germany is subject to several key regulations:

- GoBD: Requires electronic and audit-proof archiving. Documents must be stored securely and remain unaltered.

- GDPR: Protects personal data, including in digital archiving.

- HGB & AO: Define specific retention periods (e.g., 10 years for invoices and tax documents).

New Retention Periods Since 2025

As of January 2025, Germany has reduced the retention period for certain documents from 10 to 8 years to ease administrative burdens. This applies to:

- Accounting records

- Incoming invoices

- Outgoing invoices

The aim of this change is to ease the burden on businesses and reduce administrative effort. One key point remains: the retention period always begins at the end of the calendar year in which the respective document was created. An overview of additional retention periods follows.

The retention period is 10 years for

- Accounting books

- Inventories

- Opening balance sheets

- Annual financial statements

- Consolidated financial statements

- Management reports

- Organisational documentation required for understanding the above

The following must be retained for 6 years

- Received and sent business correspondence

- Copies of sent commercial letters

- Business documents with commercial or tax relevance

Fines and legal disadvantages may result from non-compliance.

Incorrect or missing archiving can lead to penalties or legal consequences. This is especially critical when archiving emails and digital receipts, where companies must ensure compliance with legal retention periods and data protection regulations.

Benefits of Digital Archiving

Still storing paper in bulky folders? Time to rethink. Digital archiving brings order and a host of smart advantages:

- Find faster, search less: Contracts, invoices, emails—everything is just a click away.

- Free up space: No more paper clutter or overflowing filing cabinets.

- Secure by design: Backups, encryption, and audit-proof storage protect your data better than any locked drawer.

- Access anytime, anywhere: Whether in the office, at home, or on the go—collaborate in real time.

- Think sustainably: Less paper, less printing, less shipping—digital archiving is efficient and eco-friendly.

With d.velop documents, making the switch is easy. Whether it’s emails, documents, or entire records—you can archive everything securely, access it anytime, and stay compliant.

💻Book Software Demo

Experience the power of d.velop’s software with a personalised live demo, easily requested with just a few clicks. Watch as the software comes to life before your eyes and ask any questions you may have in real-time.

Getting Started – Step by Step

Stacks of paper or chaos in your file system? Not for long! With these five smart steps, you’ll master electronic archiving like a pro – including audit-proof storage, GoBD compliance, and a tidy digital workspace:

1. Define Your Digitalisation Strategy – No System Without a Plan

Before you start scanning documents or saving files randomly, you need a clear direction.

Who should archive what? Which processes do you want to digitize? What does your long-term storage strategy look like? Only once your strategy is in place should you move forward.

2. Categorise Documents and Files Smartly

Whether it’s a paper document, PDF, or Excel file – everything needs its place. Categorise your document types (e.g., invoices, contracts, emails) and define a consistent system for storing and retaining them. This saves time and nerves – especially when searching for files later.

3. Choose the Right Archiving Software

Now it gets technical – but don’t worry. A good solution does most of the work for you.

It ensures that your files are archived securely, GoBD-compliant, and audit-proof. Email archiving and digital receipt storage can also be dealt with just a few clicks.

4. Set Access Rights & Get Everyone on Board

Clarify early on who can access what – and who can’t. Training sessions help prepare your team in terms of data protection, archiving software, and digital organization. Because only a well-trained team ensures smooth electronic archiving.

5. Implement Audit-Proof Archiving & Review Regularly

The golden rule: audit-proof archiving. That means: immutability, traceability, and secure long-term storage – even years later. Regularly review your archiving system, update encryption methods, and keep your backup strategies up to date.

Best Practices & Tools for Digital Archiving

Think digital files are just a buzzword? Think again. Modern archiving solutions bring structure to chaos. Here are best practices and tools to help you archive like a pro:

What Are Common Tools for Digital Archiving?

- DMS (Document Management Systems): All-rounders that organise, store, and make your documents searchable – ideal for automating business processes.

- Cloud Storage: Flexible, location-independent, scalable – but only suitable for archiving with encrypted transmission and access protection.

- Email Archiving: Emails are business correspondence. Storing them legally can save you stress (and fines) in critical situations.

What Should You Look for When Choosing a Tool?

To avoid turning your digital archive into a data jungle, keep an eye on:

- GoBD compliance – non-negotiable

- Usability – if it’s too complex, no one will use it

- Integrations – seamless connection to ERP, CRM & more

Workflow Example: From Paper Stack to Digital File

- Scanning: Old documents are scanned – ideally with OCR text recognition

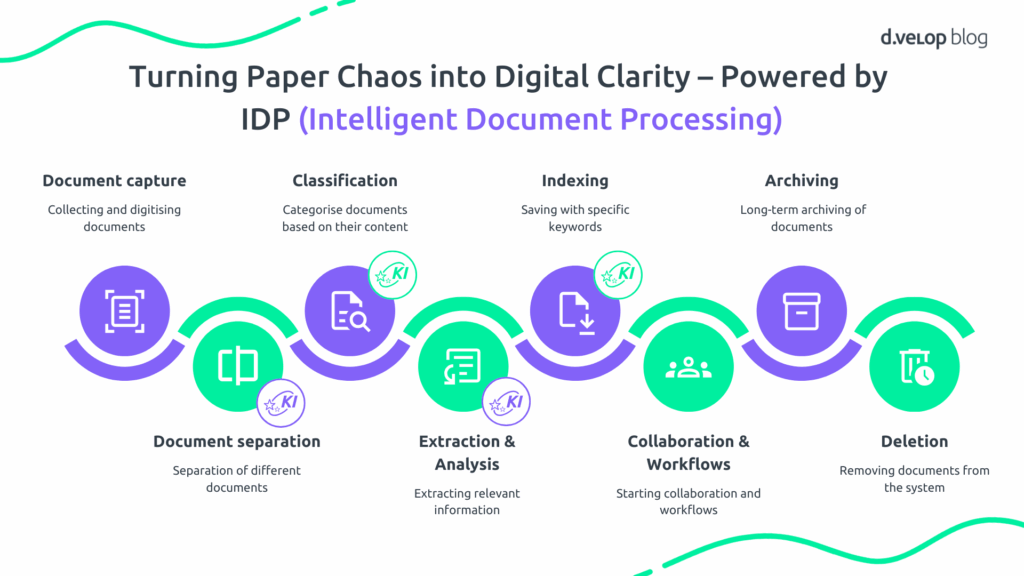

- Analysis & Classification: AI steps in – using IDP (Intelligent Document Processing), content is automatically recognized, categorised, and tagged with metadata

- Indexing & Filing: The software learns and ensures files are stored exactly where they belong

- Long-Term Archiving: Securely stored, GoBD-compliant, searchable – your digital file is complete!

A Smart Partner: d.velop

With solutions like d.velop documents, archiving documents, data, and files becomes simple.

Automatic classification, intelligent workflows, and verified legal compliance ensure that your digital archiving not only works – but impresses.

Document archiving is key to efficient work and secure information management.

Systems like those from d.velop provide structure, security, and compliance through intelligent encryption, verified backup strategies, and clear filing structures – helping you create a central archive for everyone.

Successful Introduction of Digital Dossiers in 3 Phases

In the project guide, you will learn the process for introducing digital dossiers—from the preparation phase to implementation and establishment in the company.

Why It Pays to Act Now

Those who archive smartly today save time tomorrow and stay legally protected.

The benefits? Greater efficiency, faster access, secure data – and the peace of mind that everything is under control. The risks? Outdated systems, lost files, and insecure storage that could become costly in critical situations.

The good news: You don’t have to do it alone. With professional solutions like d.velop’s document management, you bring digital order, legal certainty, and future-readiness into your organisation – structured, scalable, and audit-proof. So don’t wait – start archiving!

FAQ: Archiving Documents and Files

How do you archive documents properly?

To archive documents and files properly, they should be stored in a structured and audit-proof digital archiving system (such as DMS software), secured according to GoBD guidelines, and classified based on legal retention periods. It’s important to digitize paper documents and centrally store emails, receipts, and files in appropriate formats – so they remain accessible, exportable, and protected from unauthorized access.

Is it better to archive or delete?

In most cases, it’s better to archive than delete – especially when legal retention requirements apply.

With a digital document management system (DMS), receipts, emails, and paper documents can be classified, secured, and quickly retrieved – whether stored in an archive, folder, or digital location.

What’s the best way to store old documents?

Storing means keeping documents or files for short-term access – e.g., for editing.

Archiving, on the other hand, refers to long-term, structured, and secure storage, especially for audit-proof archiving under GoBD. Digital archiving within a modern DMS allows you to systematically sort, review, and retain emails, paper documents, and digital receipts.