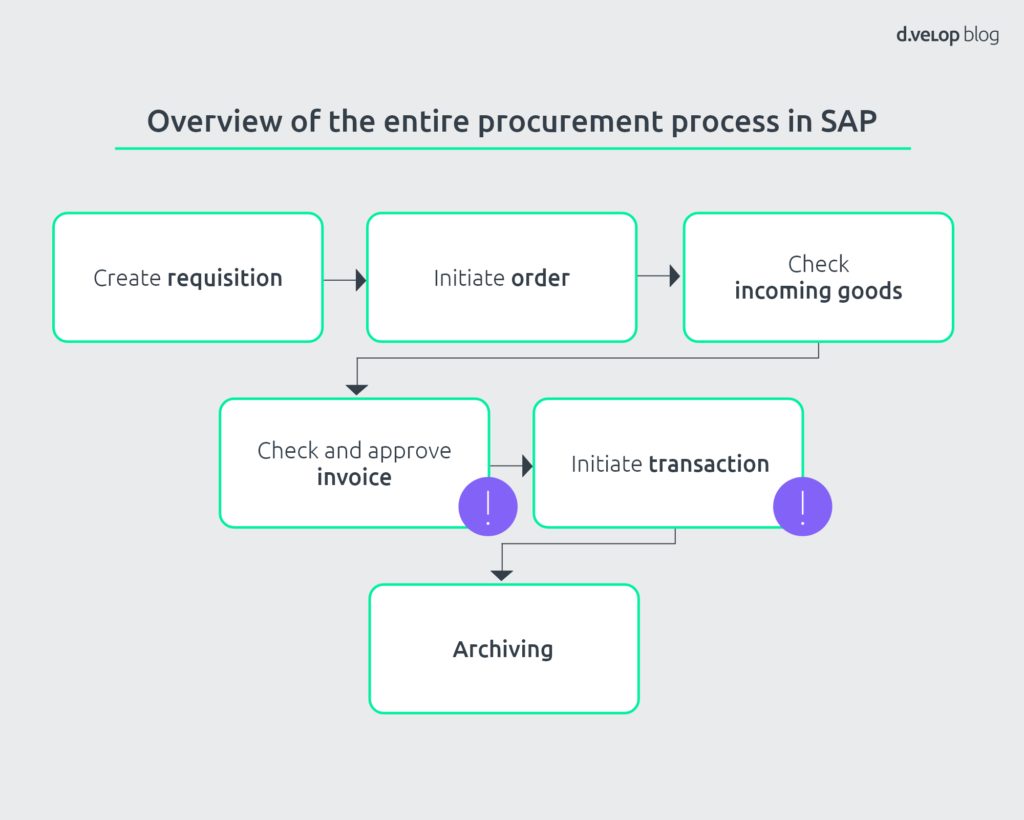

We continue our series of blog entries around the digital procurement process in SAP with SAP invoice verification. The motto of this process step is: “It’s all about the money!”. Here, the focus is on the receipt of invoices and the subsequent payment transaction.

Accordingly, this is the current stage within the SAP procurement process.

Did you know that processing a single invoice can cost up to €12?

At most companies, invoice verification and approval alone take 14 days on average. Half of the time, the three-step verification process (purchase order, delivery note, invoice) goes awry. According to a study on electronic invoices by the Institute for Information Systems at Leibniz Universität Hannover, it takes 5.25 employees on average to process an invoice and 0.50% of all invoices go missing. In light of this study, it is not surprising that it can quickly cost up to €12 to process a single invoice.

Just try and do the math for your company. One thing is for sure: Tasks which employees consider “routine”, effortless and easy to complete at first glance actually cost the company an incredible amount of money in the long run.

How are these costs generated? The following questions, which every company must answer individually during the SAP invoice verification process, reveal the answer:

- Who is able and alowed to verify invoices?

- To which employees should incoming invoices be distributed?

- How do I gain an overview of incoming invoices that are still open?

- How can I ensure audit-compliant archiving of records?

- How do I avoid duplicates and thus printing costs?

The goal therefore is to ensure that invoices are distributed, verified, signed off and posted as quickly as possible and without error. In this way, your company maintains a continuous overview of all short-term and long-term obligations for deliveries and services. You can optimize your processes by making them digital and automatic.

It would be particularly useful if you could perform all the steps of incoming invoice verification directly in your SAP ERP system, wouldn’t it

Let’s compare a non-automated incoming invoice process with the automated incoming invoice process in SAP.

Non-automated SAP invoice verification: Long cycle, processing and storage times lead to high process costs

In the first step of traditional incoming invoice verification, the invoice is received via e-mail, fax or letter. After opening it or printing it out, the record must be date stamped and then manually pre-assigned.

The next step involves copying the invoices and storing a copy in a clipboard. The original document must be distributed within the company via inhouse mail or delivered personally. As you probably know, this way of doing things can be very time-consuming since employees are often difficult to track down and your accountant then has to worry about sending the invoice out again on the following day or week. On top of that, the organization of copies in the clipboard is extremely cumbersome and copies that are not separated after the original invoice has been received can easily lead to confusion and incorrect assumptions.

After that, verification and, if necessary, forwarding and invoice approval follow. At this point, you have to identify the person who can verify the invoice. In many cases, the supplier does not copy the order numbers or buyers from the initial purchase order to the invoice. As a result, the verifier has to spend time searching for and reconciling the invoice in the system after it has been received. Following verification, the invoice has to be sent back to financial accounting, in which case the Head of Finance and Accounting is unable to recognize the processing status in the system. Even if an invoice is forwarded internally, its current status and the person who has it in their possession is not always apparent.

The invoice then makes its way back to financial accounting. At this point, the creditor and cost center must be verified and then a second verification of the cost centers must be performed. At this stage, you should anticipate questions from various departments. The accountant must then enter the invoice manually into the system (if it was not pre-entered) and then post it. Here again lurk potential errors. The created copy must be discarded and you have to manually store all documents over again.

Automated SAP invoice verification: Process transparency using the incoming invoice journal

In the automated process, invoices are scanned in stacks once they have been received. Records received per fax or e-mail are automatically captured via scanning software. During scanning, the most crucial data is captured via OCR. This allows the cost center to be automatically copied to the record during the initial capture.

Purchase orders without an order reference are automatically pre-captured by the system and the invoice is displayed in the incoming invoice journal. The journal is a tool used to analyze all incoming invoices. During analysis, it is instantly apparent which invoices have been received from which creditor, in what amount and with which discount period. The processing status and the employee currently processing the invoice also become visible. This makes follow-up questions regarding the status of invoices unnecessary.

Documents are then promptly forwarded to the buyers via the workflow. Invoices are distributed much more quickly and directly to the responsible parties without a lot of time and effort. This grants you more time and drastically reduces organizational costs. The purchase order is forwarded directly to the buyer via an automated workflow using the data captured by the OCR scanner. The forwarded data is then updated in the incoming invoice journal and the Head of Finance and Accounting knows the processing status as well as the employee currently processing the invoice.

During verification, the purchase order, posted incoming goods and invoice are automatically reconciled with each other for the verifier, which means that quantities and totals are also reconciled. If the invoice is highlighted in green, the three-step verification was successful and the verifier can check off the invoice as verified and pass it on in the workflow. If the employee responsible for approving the invoice was selected per the workflow, invoice approval can then be performed immediately based on the previous reconciliation of the incoming goods with the purchase order and invoice. If desired, this can be done by management or department heads via a mobile device and without SAP access. Multi-stage approval can also be implemented in the SAP system. After approval, the invoice can be posted with a click of the mouse and made accessible for the payment procedure. All important process-related documents and processing actions are automatically archived and, after posting, the invoice is also automatically deleted from the incoming invoice journal.

The following graphic shows a comparison of the two processes:

The workflow supported by d.velop solutions for SAP is significantly shortened and less prone to error compared to the typical process. The subprocesses of the SAP invoice verification can be performed more quickly and more easily. All things considered, this has further benefits.

Overview of all the benefits of SAP invoice verification

- Process transparency using the incoming invoice journal

- Shorter processing and storage times

- Timely payment to qualify for discounts

- Precise, objective verification

- Variable mapping of the company processes in the workflow

- Cross-location verification and approval

- Central data management without redundant duplicates

- Automatic determination of processing employees

- Audit-compliant storage and SAP archiving of the workflow log

Since the benefits are clear now – only the right solution is missing. d.velop incoming invoice automation for SAP is a solution especially developed for SAP that digitizes and automates processes of invoice processing. You can find this and more information on our page about the digital procurement process in SAP.