In times of increasing use of AI, banks and other financial institutions face the challenge of making their processes not only more efficient but also more secure and transparent. A key element in this transformation is the digital credit file. It not only replaces traditional paper filing systems and bulky filing cabinets but also forms the foundation for further automated workflows in the lending business.

How and why DZ BANK introduced a digital credit file and how AI-driven technologies such as Intelligent Document Processing (IDP) help to make credit applications smarter is what you’ll find out in this blog article.

A digital credit file: What is it exactly?

There are many different types of digital files in various formats, including the digital credit file. It is part of an electronic document management system that stores, manages, provides and shares documents in digital form.

The advantages compared to traditional paper files gathering dust in filing cabinets are above all:

- Traceability and transparency

All changes to documents are recorded in detail and without gaps in the digital file. Version control and the linking of documents to multiple files ensure that the most up-to-date version is always available in the system and that no redundant data exists. - Compliance with legal retention obligation

In the digital credit file, banks and other financial institutions can archive credit-relevant documents in an audit-proof manner while complying with statutory retention and deletion periods. - Access control through permissions management

Central permissions management protects against unauthorised access and ensures GDPR-compliant working.

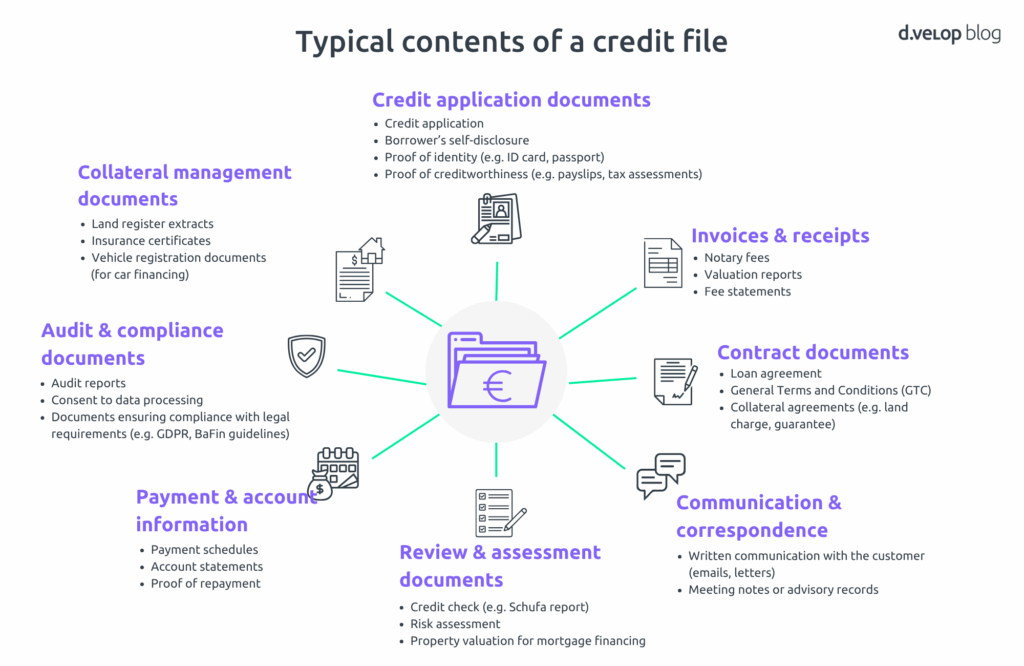

A digital credit file typically contains a wide range of documents that reflect the entire lifecycle of a loan.

Digital credit file: DZ BANK AG leads the way

After the initial cost-benefit analyses in 2014 and the project launch in March 2015, the rollout of the digital credit file at our client DZ BANK AG took place in May 2016.

Added value the DZ BANK gains from the digital credit file

“Why should we introduce a digital credit file?” This was a question Vera Buck, Project Manager at DZ BANK AG, had to answer more than once when speaking to colleagues and supervisors. Following an in-depth concept study, she was convinced that this approach would unlock optimisation potential, which was clearly defined in the project objectives.

- The digital credit file creates a uniform file structure by standardising different filing systems.

- A central storage location ensures location-independent access, which is particularly beneficial for employees working remotely or on the go.

- Consistent filing rules and authorisation concepts help ensure quality. Establishing a uniform filing standard for a paper archive is time-consuming and, if at all achievable, only possible through constant monitoring. With an electronic archive, a standard file plan is created collaboratively, defining a clear file structure. This enables a uniform system across locations and teams.

- The digital credit file also reduces search and filing times. Thanks to the indexing of electronic files, they can be searched quickly and easily. Several users can access a single file at the same time, eliminating the need to send it back and forth. Punching holes and filing paper documents is a thing of the past.

In addition to all these advantages, the digital credit file offers another long-term benefit that DZ BANK AG recognised right away: it is only the beginning and serves as the foundation for further digitalisation projects. With the introduction of the digital credit file, the groundwork has been laid for a fully digital processing workflow in the lending business. The following illustration makes this clear at a glance.

Individual structures and requirements of DZ BANK

Once the decision to introduce a digital credit file had been made following a thorough evaluation, the next step was to capture the bank’s individual structures and requirements. From analysts to credit officers and collateral managers, there are many potential users of the digital credit file at DZ BANK. Over the years, different filing systems had developed across departments and locations. In addition, the filing systems of the two entities were to be standardised in the future. It quickly became clear that adjustments to the standard software and the standard file plan provided by d.velop AG would be necessary.

A guiding principle developed jointly by DZ BANK and the d.velop team set the framework for the entire implementation: “One standard file plan for everyone.”

Professional and technical implementation of the digital credit file

- File structure: Development of a standard file plan for DZ BANK

A file structure serves both as a research tool and as a drag-and-drop zone. Individual structures are fully restricted in DZ BANK’s system. For example, creating personal “hand files” is not permitted to ensure that the new filing standard is fully established and consistently applied.

Digital credit file vs. classic file server structure: What’s the difference?

At first glance, it may seem that there is no difference between a digital credit file and a traditional file server structure. However, a file server structure only offers a vertical level of organisation. In contrast, the digital file uses a linking structure that connects files and documents. This creates new logical file types based on these links.

Using indexing features such as “transaction,” “contract number” or “collateral object,” all files can be searched at once, and the relevant document is displayed quickly. In addition, the documents are archived in compliance with GoBD regulations, unlike on a conventional server.

- Creating files: Learning to index

Based on the specific requirements of DZ BANK, a form was developed to enable users to create files easily and efficiently. Certain indexing features must be entered at this stage to support quick searches and precise identification. Some of these features are filled in automatically by the system and only require a brief review. - Interfaces: Integrating existing systems effectively

The digital credit file should be seamlessly integrated into existing systems. A direct interface to credit proposal management is designed to ensure three key synergy effects:- Enabling the direct filing of credit proposals (including attachments) in the electronic credit file

- Automated completion of the indexing form to avoid duplicate data entry

- A bidirectional interface that allows documents from the digital credit file to be attached to a credit proposal

A connection to the master data system was also necessary to process business partner data during file creation and to implement the authorisation and role concept.

- Access permissions: Who can view and edit what?

With 1,200 users, a sophisticated authorisation system was required. The basis for access permissions was the assignment of encrypted account managers in the system. In addition, the associated group, including the line manager, was granted access. Functional permissions (view, edit, etc.) were derived from the employee’s role. Individual adjustments, such as expanding or restricting viewing and editing rights at various levels, were also possible without having to change the account management types in the master data system. - Digitalisation of existing records

Over the entire project period, more than 38,000 existing files — amounting to around 13.4 million sheets of paper — were digitised. The electronic credit file of DZ BANK AG currently contains more than 600,000 documents. - Rollout and user acceptance

Before the digital credit file was rolled out company-wide, a pilot phase was carried out at one location to gather feedback and implement adjustments. Involving future users and administrators was a key aspect, according to Vera Buck. A project of this kind depends heavily on user acceptance. A pilot project can help further improve user-friendliness and increase acceptance across other departments and locations.

Project guide: Successful Introduction of Digital Dossiers in 3 Phases

Smart credit application processing through the combination of digital credit file, IDP and AI

Let’s take a step back in the credit process, beyond the example of DZ BANK AG. Typically, banks receive a large number of documents through various channels before these are properly stored and managed in the digital credit file. This is where AI-driven document processing can come into play — both at the point of document intake and later during work with the digital credit file — to optimise processes and increase efficiency.

IDP for the automated separation, classification and extraction of documents

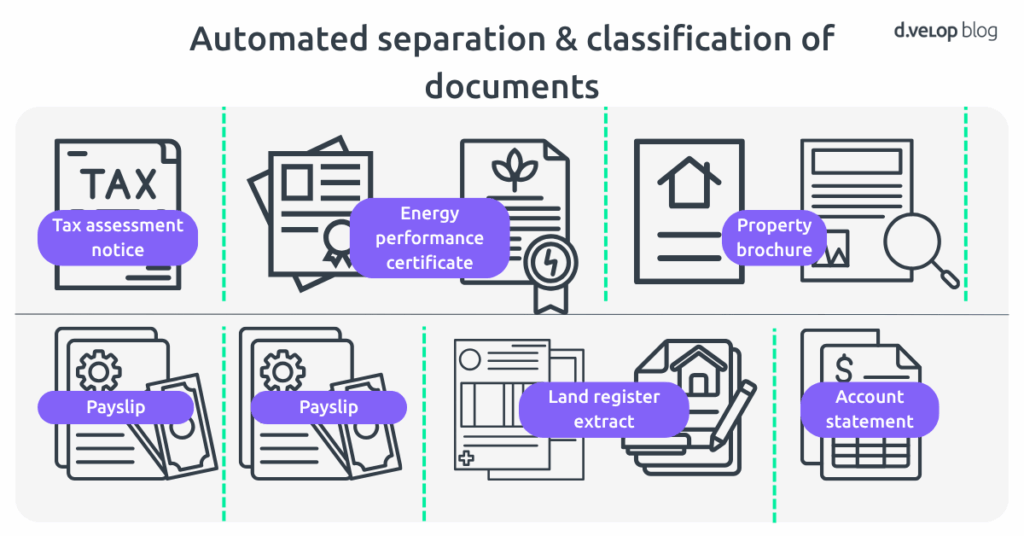

With Intelligent Document Processing (IDP), documents can now be automatically separated, classified and extracted. But what does this mean in the context of digital credit files?

Simplified receipt of credit applications and filing in the credit file

Credit-relevant documents such as account statements, payslips or land register extracts are received as PDFs, JPGs or in other formats. Using AI-powered document processing, these can be automatically split and categorised when different types of documents arrive bundled together in a single file. Individual separation options can also be configured. For example, it can be defined whether each payslip should be stored as a separate document or whether all payslips should be grouped together in one file.

The extraction of data from documents and the automatic filing of classified documents into predefined file structures is also made possible through AI.

In the past, we have already implemented entire annual financial statements for clients, where more than 200 data fields had to be extracted. This shows how detailed and in-depth the automation of such document types can be.

recalls Martin Jarosch from our partner Buildsimple.

Overall, this process turns unstructured data into structured information that can be stored in a digital archive, for example in a digital credit file.

A digital credit file in the DMS as a smart storage solution and a foundation for further processes

Once the documents have been correctly filed in the appropriate digital credit file in the document management system (DMS) according to their type, it is crucial that they can be found quickly. Keyword, full-text and detailed search functions as well as filtering options ensure fast and efficient processes.

With an AI assistant integrated into the DMS, documents in the digital credit file can be summarised, and questions about individual or multiple documents can be answered. It is also possible to trigger document-driven processes directly from the digital credit file, such as initiating a signature workflow in the credit process through the integration of our digital signature solution.

Using a digital credit file in the DMS from d.velop AG ensures compliance with GoBD and regulatory requirements. Document versioning and an activity log provide transparency throughout the entire credit application process. Legal retention and deletion periods are also consistently observed. Individual permission and access controls, as seen in the DZ BANK project, add an extra layer of security for documents stored in the digital credit file.

Conclusion: Why banks should rely on an AI-powered digital credit file

A digital credit file combined with AI offers banks decisive advantages. Automated data processing using IDP significantly speeds up the processing of credit applications, increasing both efficiency and responsiveness. At the same time, the digital archive ensures audit-proof, traceable and centralised documentation, which is ideal for collaboration across different locations. Regulatory requirements such as GoBD are met, reducing compliance risks. In addition, automated processes relieve employees of administrative tasks, creating more capacity for customer-focused services. The result: simple and secure processes, greater customer and employee satisfaction.

💻Book Software Demo

Experience the power of d.velop’s software with a personalised live demo, easily requested with just a few clicks. Watch as the software comes to life before your eyes and ask any questions you may have in real-time.