Purchase-to-pay process – maybe you’re already familiar with the term, but for those who aren’t: a P2P process doesn’t have anything to do with peer-to-peer connection. Rather, it’s a short form for “purchase to pay”, sometimes also referred to as procure-to-pay. When we say P2P process, we mean the ‘purchase to pay’ process as it exists in corporate environments.

What is a purchase-to-pay process?

The purchase-to-pay or procure-to-pay process is a sequence of steps that extend from procurement of products or services through to payment of the invoice. It includes a purchase requisition, a purchase order and order confirmation, then delivery and finally processing the invoice, along with all the associated verifications, approvals, and documents.

Why do organisations need an automated P2P Process?

The purchase to pay process covers three core areas within any organisation: procurement, goods receipt/logistics, and finance & accounting. In addition, the process runs through various hierarchical levels within these departments. It is therefore common for a wide range of people and teams to be involved in the overall workflow. This leads to numerous individual steps and requires extensive coordination when handled manually.

But what prevents organisations from introducing a streamlined procure to pay process?

- Outdated IT systems

- Limited resources

- Restricted technical capabilities on the supplier side

- Lack of willingness within finance departments

Manual procure to pay process at a glance

As an organisation grows, the complexity of the purchase to pay process also increases. The larger the company, the more people, departments, business partners and, consequently, additional workflows are involved. The following graphic illustrates the process:

Common mistakes in the manual Procure to Pay Process

A process of such complexity is naturally prone to errors. Pitfalls in a non-automated purchase to pay process are therefore unfortunately quite common. When the process is handled primarily by manual effort, it requires significant time and staffing resources, leaving a wide margin for mistakes.

Statistics confirm this: on average, 25 % to 50 % of process costs can be saved through automation. In addition, 33 % of companies that have automated their procurement processes report fewer incorrect or duplicate payments.

Here are some typical obstacles organisations face:

- Long processing times

- Media disruptions between requisition, purchase order and invoice

- Lack of transparency

- Additional workload for employees

- Loss of cash discounts

- Poor oversight in liquidity planning

A Few Steps to Automated Procure-to-Pay Processes in SAP

How can pitfalls in the Purchase to Pay Process be avoided?

1. P2P Solutions for process optimisation

The key lies in optimising the purchase to pay process. When talking about process optimisation, another term quickly comes to mind: digitalisation. A digital, (semi-)automated purchase to pay process can be designed efficiently while minimising potential sources of error. A software solution provides maximum transparency throughout the entire P2P workflow – including its individual sub-processes.

Wenn Sie einen Scheißprozess digitalisieren, dann haben Sie einen scheiß digitalen Prozess.

If you digitalise a lousy process, then you have a lousy digital process.

Thorsten Dirks

Former Bitkom President

Key questions in the P2P Process – Metrics for process digitalisation

The guiding principle is: “As complex as necessary, as simple as possible.” With this in mind, an initial analysis of the P2P process should address the following questions:

- Which departments and employees are currently involved in the procurement process?

- Which errors and coordination efforts occur on a regular basis?

- Where does the highest workload and burden arise within the process?

- Is company liquidity put at risk due to the current process?

Automation as an efficiency booster for the P2P Process

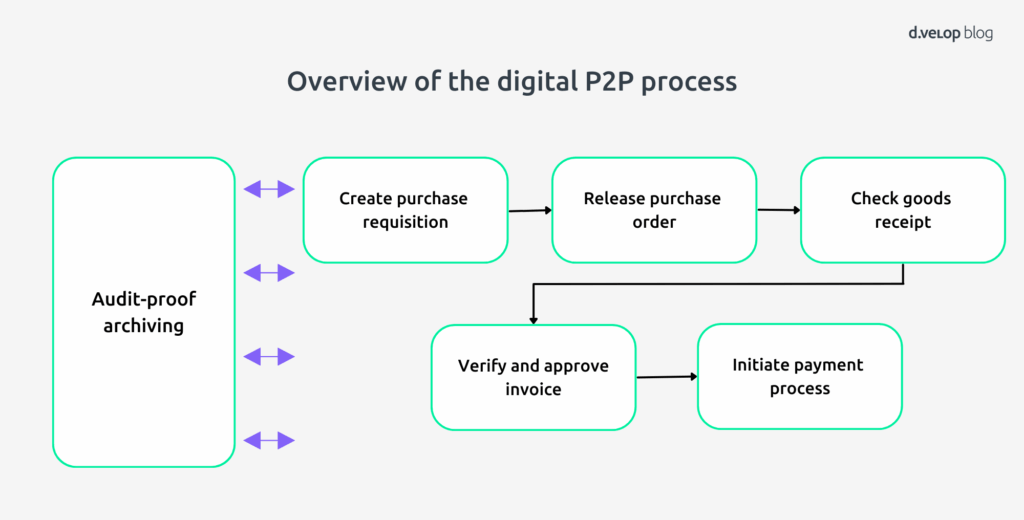

The purchase to pay process holds enormous potential that can be unlocked through digitalisation, taking efficiency to a new level. The following graphic illustrates the fully digitalised process:

Let’s begin with the requisition stage: with the right software, a requisition can be created centrally, digitally and transparently. This ensures that it is visible to all relevant stakeholders and reaches the correct person for approval. The requisition forms the basis for an accurate purchase order with the right goods in the right quantity at the right time from the right supplier.

This first step of the purchase to pay process is crucial for all subsequent workflows and should therefore be error-free, leaving no open questions, in order to serve as a reliable foundation for the order.

Subsequent steps such as purchase order, order confirmation, goods receipt and invoice processing also benefit from digital handling. Digital checks and matching against process-relevant documents provide greater efficiency, transparency and fewer errors. With digital document management, all documents are immediately archived in a legally compliant and audit-proof manner.

Logistics Group International GmbH shows how it’s done

Logistics Group International GmbH (LGI), a leading logistics service provider with around 5,000 employees, has fundamentally modernised its paper-based procure to pay process. Before the transformation, approximately 70,000 documents had to be processed manually each year – involving high effort, little transparency and frequent media disruptions.

By introducing a digital purchase to pay process, the entire workflow was automated and integrated into the existing SAP system in just 10 weeks. The intuitive interface, automated approvals and centralised data management delivered:

- Transparency across all process steps

- Time savings through streamlined workflows

- Error reduction through digital checks and allocations

- User-friendliness for more than 420 users

- Audit compliance through central archiving

Conclusion

A digitalised procure to pay process is more than just a technical optimisation – it fundamentally transforms procurement and payment workflows.

By automating and digitalising individual process steps, manual sources of error are reduced and valuable resources are conserved. Employees are freed from repetitive tasks and can focus on more strategically important activities.

In short, a digital purchase to pay process is not only more enjoyable because it is simpler and faster – it also lays the foundation for a modern, future-ready procurement process.

Questions about Purchase to Pay (P2P)

Purchase to Pay (P2P) is the procurement management process that covers the entire purchasing workflow from requisition through to payment.

The purchase to pay process is the complete procurement management workflow, starting with identifying the requirement and including sourcing, delivery, invoicing and final payment.

The advantages of the P2P process include greater efficiency, reduced costs, improved control and transparency, fewer errors and risks, faster response times and increased customer satisfaction.