At a Glance – Your Key Learnings

- Automating accounting means handling recurring tasks digitally, based on rules and AI, in compliance with GoBD regulations

- Tasks include document recognition, pre-accounting, approval, posting, payment reconciliation, and archiving

- Result: fewer errors, shorter processing times, and greater transparency

What does automating accounting mean?

Whoever still thinks that accounting is done with paper, pen, and a calculator is mistaken. The digital transformation has long since reached the world of accounting. With automated accounting, businesses can now handle accounting processes and tasks more quickly and accurately, boosting productivity and remaining competitive in the long term.

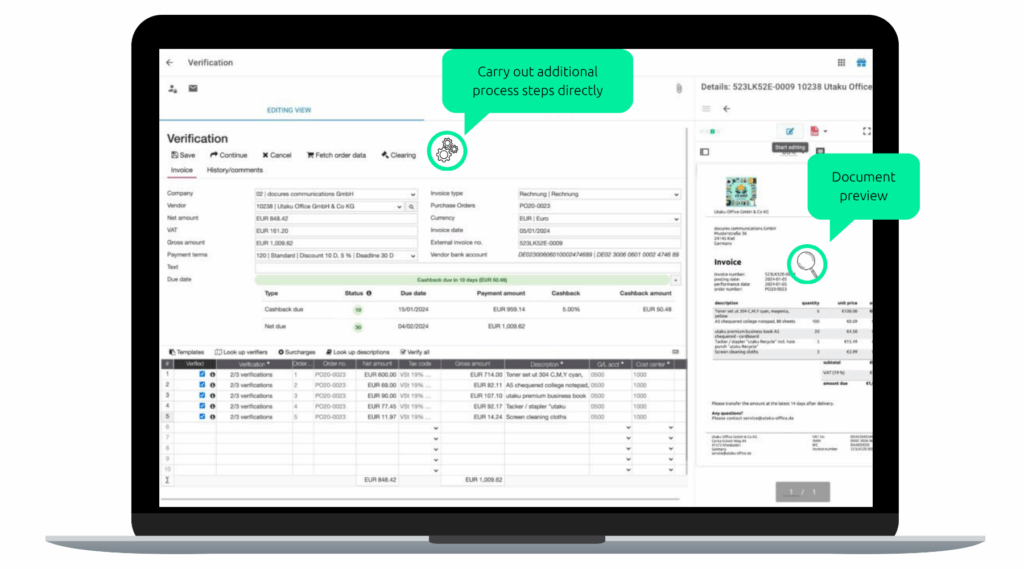

Automating accounting is not just about turning paper into PDFs. Automation means: documents are captured using OCR, data is checked against defined rules, and tasks are largely processed in the background thanks to AI – from recognition and pre-accounting to approval. The foundation for this includes reliable OCR capture, AI-supported account assignment, RPA for recurring routines, and an audit-proof DMS as the backbone of document storage. A positive side effect of this transformation is that the dusty image of accounting is being replaced by that of a modern and exciting department.

What can be automated in accounting?

In the past, documents would arrive at the company by post, be distributed across various departments, and filed in physical folders. This often involved manual filing, document management, and unstructured digital folders. Today, many companies already use digital inboxes, structured digital filing systems, and a document management system (DMS). This allows the entire process – from document receipt to legally compliant archiving – to be digitised and automated. All relevant accounting documents – such as contracts, invoices, quotations, delivery notes, or even emails – can be stored and processed within such a DMS. In addition, third-party systems can be seamlessly integrated, creating a central hub for all relevant information within the company.

Don’t just digitise – automate!

With the digitalisation of data in companies, automation quickly followed suit. Thanks to our solution, clearly defined processes can now be handled independently and fully automatically. This includes digital invoice processing, which digitises and optimises the entire invoice workflow. The simplified, accelerated and efficient processes help reduce costs and save time.

Mandatory e-invoicing: Digitalisation with momentum

Another milestone on the path to digital accounting is the legal obligation to issue electronic invoices, which has been in effect for all domestic companies since 1 January 2025. This marks the end of the simple PDF – a genuine e-invoice must now comply with the requirements of the European standard EN 16931. In Germany, the formats XRechnung and ZUGFeRD from version 2.0.1 onwards have become established for this purpose, although certain profiles may deviate from the standard.

This change affects not only the issuing but also the receiving of invoices: since the beginning of the year, companies must be technically capable of receiving e-invoices – without exception. Transitional periods apply to the issuing of invoices: until 31 December 2026, so-called “other invoices” may still be used. Small businesses with a previous year’s turnover of no more than €800,000 benefit from an extended deadline until the end of 2027. After that, e-invoicing becomes mandatory.

This legal development highlights how important it is for companies to digitalise and automate their accounting processes. Only with a modern document management system and a well-designed digital infrastructure can e-invoices be processed, archived, and integrated efficiently into existing workflows.

Automating Accounting: A Pragmatic Start in 4 Steps

1) Greater transparency and better overview

Instead of searching for documents in countless disorganised folders or a database, receipts, invoices and records can be stored automatically, in a structured and legally compliant manner. The time-consuming hunt for specific documents buried in piles of paper is now a thing of the past.

2) Fewer faulty processes

Anyone can overlook a detail or make a mistake – it’s perfectly normal and can happen to the best of us. Most errors occur during the transfer of important data from A to B to C and require corrections. This may result in duplicates, and the correct document must be identified from a large number of invoices and records. Accurate and consistent data across all processes, departments and applications is essential and extremely important for accounting.

3) Time for what really matters

In addition to cost savings through automated accounting, another clear advantage is the time saved. The less time that needs to be spent on accounting thanks to automation, the more time employees have available for other important tasks.

4) Relieving and motivating staff

The time saved also helps to relieve staff, as tedious routine tasks are eliminated through automated accounting, allowing employees to focus on other matters. This variety can lead to increased motivation and also boosts individual productivity.

The document management system from d.velop helps us tremendously in processing incoming invoices more quickly. The DMS identifies formal errors and also performs a computational check to ensure the amounts and VAT are correct. The processing of digital invoices is now much faster, and handling the process is significantly easier for the accounting staff than it was before.

Nicole Pollack

Betriebswirtin und Product Owner Internal IT Applications

Ableton AG

Automating Accounting: Common Mistakes – and How to Avoid Them

Automating accounting can lead to significant efficiency gains – provided common mistakes are avoided. One frequent pitfall is that processes are digitised but not standardised. Without clear rules, chaos ensues instead of structure. Equally problematic are shadow processes in Excel or email that operate outside central workflows. These must be consistently eliminated.

Special cases such as price discrepancies or partial invoices should be defined early and mapped out technically – otherwise, manual rework may be required. Compliance must also be considered from the outset: GoBD-compliant documentation, role allocation, logging, and archiving need to be planned from the beginning.

And instead of a “big bang” approach, a gradual rollout is recommended. Starting with pilot projects allows for targeted process optimisation and enables sustainable automation of accounting.

But what’s the best way to get started with automating accounting?

The digitalisation and automation of accounting can be highly individualised. It’s essential to thoroughly analyse your own processes to identify specific problem areas and opportunities for optimisation. Based on this, you can define your requirements and a clear vision of your goals. When selecting a provider, it’s important to carefully consider their experience in process digitalisation and automation, their technological expertise, and their security standards.

Most importantly: Stay on the ball!

Many working methods are undergoing major changes due to digital transformation. To keep up, avoid falling behind, and maintain strong competitiveness, switching to automated accounting makes sense. Introducing digital invoice processing is a great starting point for questioning, rethinking, and optimising existing processes.

Digital Invoice Processing | Tips and Pitfalls in Project Planning