For many years organisations have tried to automate the accounts payable (AP) business process. Technology has provided tools to allow businesses to scan paper invoices, extract their data, match it against purchase orders, route them for approval, and pay any that are approved. However, few organisations have a single end-to-end process to deliver this process.

Digital optimisation allows organisations to join the dots — to connect the systems together as part of a seamless, end-to-end flow that reduces human input, removes errors, and increases speed and efficiency.

This blog looks at the benefits of investing in end-to-end AP automation, the challenges of trying to implement it, and what those solutions might look like.

Definition AP Process

The Accounts Payable (AP) process refers to the set of activities and procedures that a business follows to manage and settle its short-term financial obligations to suppliers or vendors.

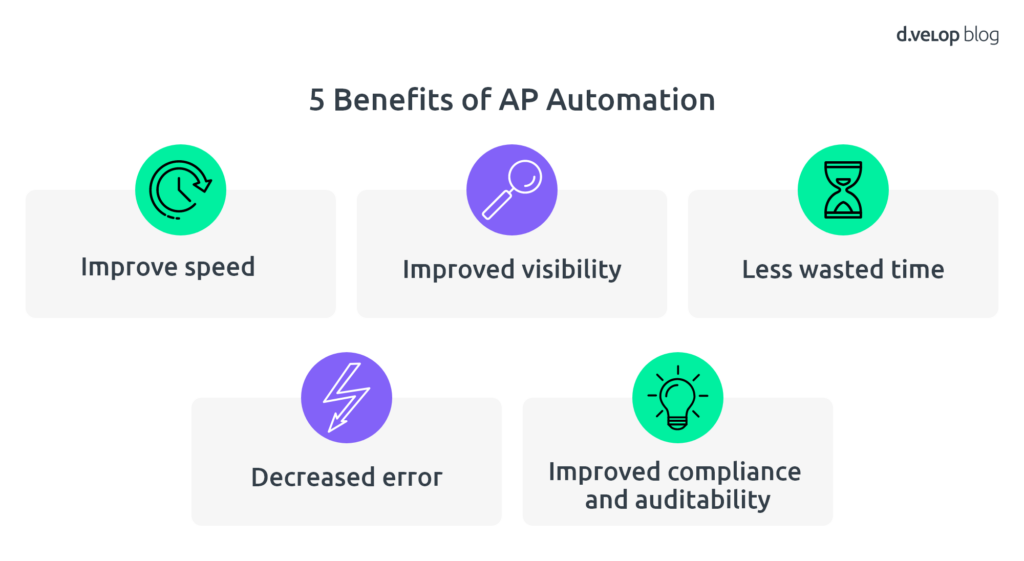

5 benefits of AP automation

There are several reasons why organisations invest heavily in AP automation. ome of which are readily apparent and some of which have a more subtle impact.

1. Improved speed

The most obvious benefit of automation is the way that it boosts the speed and efficiency of the AP process. After all, computers can work much faster than human workers, and can operate 24/7. This improved efficiency reduces invoice cycle times, resulting in quicker service and lower costs, and as a result, companies using AP automation see 81% lower processing costs and 73% faster processing cycle times.

2. Improved visibility

Clear insights into your organisation’s spending can be invaluable, and one of automation’s subtler benefits is the ability to surface this information as early as possible in the process. Rather than only coming together once approvals and exceptions have been sorted, a joined-up AP process allows organisations to stay aware of upcoming payments. This insight allows organisations to enjoy the benefits of early payment discounts and ensure they stay on top of their cashflow.

3. Less wasted time

Manually processing hundreds of invoices is time-consuming and, frankly, boring. If you have a team of highly trained AP professionals, they can benefit from spending less of their day on repetitive form-filling and more of it on more valuable and strategic tasks such as analysing spending patterns, improving relationships with vendors, and planning for any upcoming investments.

4. Decreased errors

It’s not something we like to admit, but even the best of us can make an error. Between typos, mis-clicks and misunderstandings, manual processing leads to mistakes, with research estimating that errors add about €0.59 to the cost of every invoice. With two- and three-way matching – the process of automatically comparing invoices to purchase orders and receipts – you can significantly reduce costly mistakes.

5. Improved compliance and auditability

Organisations need to ensure that their financial processes are well-documented and well-secured. Automation can help on both fronts. The automation tool records every transaction and process without relying on human workers to remember to document their actions, while access controls ensure that sensitive financial information is never accidentally shared with anybody lacking the right credentials.

Challenges with AP processing

In an ideal world, automating your existing AP process would be as simple as buying an automation tool, installing it, and working out how to make the most of your newly acquired free time. However, for many organisations, things aren’t quite that simple. There are often several barriers standing between the AP team and easy automation.

Many popular versions of invoicing software, such as Microsoft Dynamics 365 Finance and Operations (F&O), struggle when it comes to automation and miss out on key elements such as automatic approvals and neatly linking with the ERP system for payment and recording.

Integration

For example, organisations often struggle to integrate any automation tool into their legacy systems. These older systems were usually designed for manual processing and lack the ability to efficiently share data with either automation tools or wider document management software.

Changes

On top of this, many AP automation efforts are slowed down – or even completely derailed – due to employees’ resistance to change and unwillingness to adopt the new solution. Many people are comfortable with how things are done and may be hesitant to adopt new technology. This is especially true for businesses that have been using manual AP processes for many years.

There are several reasons why people may resist change. They may be afraid of the unknown or worry that automation will lead to job losses. They may also be concerned that automation will not work as well as management believes it will.

“Comfort and the fear of change are the greatest enemies of success.”

And even if people are willing to change, some of them may not be willing to adopt AP automation because of the cost or complexity of the process. For this reason, it’s important to involve employees from the early stages and emphasise the benefits of automation – not just for the organisation but also for the AP team.

Security and privacy

The final major challenge facing automation is one of security and privacy. Organisations must protect sensitive financial data from unauthorised access or breaches, and this obligation can sometimes clash with the needs – real or perceived – of automation tools.

This strict security requirement means it’s vital that any AP automation solution adheres to industry compliance regulations and security standards. This includes features like strong encryption, clear access controls, and strict data segregation.

Realising the promise of end-to-end invoicing

Manually entering incoming invoices is a time-consuming and costly process. Long waiting and processing times can lead to missed discounts, and there is no transparent overview of which employee is currently processing the invoice. This can lead to confusion and delays.

However, while some of the barriers standing between businesses and easy automation require internal change and leadership, some can be tackled with the aid of appropriate software. These tools allow ERP systems to communicate cleanly with invoicing software and even SharePoint-based document management systems. This technology makes it much easier to introduce and implement automation across an entire AP process. It eliminates the need for human workers to manually approve and copy documents when the workflow switches between applications.

An orchestration tool such as d.velop’s digital invoicing technology can help connect the dots. It can help your existing software deliver maximum performance without having to make major changes to your workflow or technology stack.