In a recent interview, our Senior Solution Engineer, Florian Breuer, offered insights into how AI and modern document management technologies are redefining AI in insurance. The discussion highlighted emerging trends, key challenges, and the opportunities shaping the industry today. Below, we summarise the most important takeaways.

The data flood in the insurance industry

Insurance companies have always been data-driven. Policy terms, contracts, claims files, regulatory requirements, and internal guidelines form the foundation of daily operations. However, this overwhelming volume of information is increasingly becoming a challenge. Every day, insurers receive new documents via mail, email, or digital portals. In addition, outgoing documents such as policies, claim notices, or invoices must also be stored and managed.

Traditional document management systems have simplified this process, but they reach their limits when faced with today’s volume and complexity. Employees often have to search manually, click through folder structures, and work with multiple systems at once. This is where artificial intelligence in insurance makes a decisive difference: it transforms simple storage into active knowledge management.

From Generative AI to Agentic AI

A major technological breakthrough came in 2023, when tools like ChatGPT and Copilot demonstrated the power of generative AI. For the first time, it became possible to communicate with a computer in natural language and receive precise answers instantly. For many, this was a revolution—for insurers, it was an opportunity to fundamentally change how knowledge is handled.

Agentic AI goes one step further. It not only understands queries, but can also perform actions, manage processes, and extract targeted information from document repositories. The d.velop pilot is an example of such a system. It analyses entire file collections, clusters documents based on validity, and provides answers to specific questions—always with direct references to the corresponding sources.

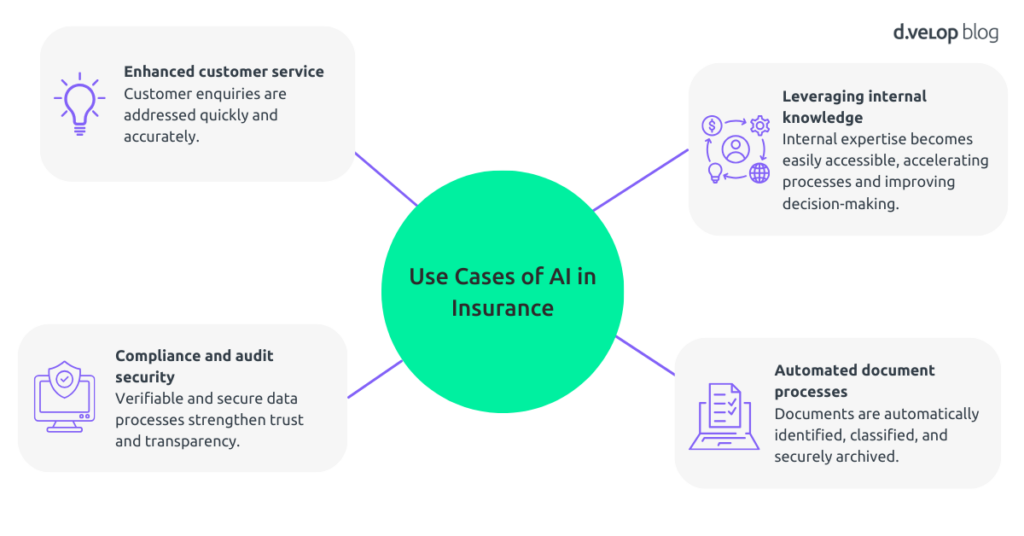

4 Typical Use Cases of Artificial Intelligence in Insurance

1. More Efficient Customer Service

Consider a typical customer service scenario: a customer calls and asks whether their e-bike is insured against theft and up to what amount. Although the employee has access to the contract documents, they may not know every detail. Without AI, they would have to search extensively or forward the case to a specialist department. With an AI assistant, the solution is simple: the question is entered, the assistant searches all relevant documents, and returns an immediate, accurate answer. This boosts both efficiency and customer satisfaction.

2. Automated document processes

Every day, insurers receive countless incoming documents—letters, scanned papers, PDFs, or portal uploads. AI can automatically detect, classify, and assign these to the correct file. At the same time, outgoing documents like policies or addendums are stored in a compliant and audit-proof manner. This creates a seamless, automated document workflow that saves time and reduces errors.

3. Compliance and Audit Security

One key advantage of artificial intelligence in insurance is its ability to meet compliance requirements. Insurers handle highly sensitive data and are obligated to document it in an audit-proof manner. Modern AI systems therefore not only provide answers, but always include references to the underlying documents. This ensures verifiability and transparency, reduces risks, and increases trust.

4. Leveraging Internal Knowledge

Insurers also benefit internally. Guidelines, work instructions, or regulatory requirements can be retrieved via a simple search query. Instead of flipping through long manuals or waiting for feedback from other departments, employees receive the information they need instantly. This accelerates internal processes and improves decision quality.

Technological Foundations of AI in Insurance

For artificial intelligence to unfold its full potential in insurance, it requires a combination of multiple technologies:

- Vector databases serve as the foundation by translating unstructured data such as PDFs or scans into a format AI can understand. This allows the system to recognize relationships between terms like “bicycle” and “e-bike,” even when phrased differently.

- Document management systems ensure all information is stored in a compliant and audit-proof manner, respecting complex permission structures. Source references guarantee traceability and allow employees to access documents directly.

- Interfaces connect structured data from policy administration systems or CRM solutions with unstructured documents.

Challenges for Insurers

The introduction of artificial intelligence in insurance brings challenges as well as advantages. A key hurdle is managing permissions. AI systems must respect the same access rights as existing DMS solutions. Another challenge is the enormous volume of data that must be processed efficiently. Transparency is also critical ‒ employees and customers must be able to trust the technology, which is only possible when answers are fully verifiable.

Another strategic decision insurers face is whether to develop technologies in-house or purchase them. Training a proprietary large language model is costly and resource-intensive. As a result, many insurers focus on integrating existing solutions and enriching them with their own data.

Strategic Opportunities Through AI in the Insurance Industry

When implemented effectively, artificial intelligence offers tremendous potential. Insurers can shorten processing times, reduce error rates, and improve customer service. At the same time, the workplace becomes more attractive, as employees are relieved from routine tasks and can focus on value-adding activities.

Another advantage is competitive differentiation. “Insurers that invest early in AI and document management gain a clear competitive edge,” emphasises Florian Breuer. Customers today expect quick, accurate, and reliable answers. Those who can deliver them strengthen customer loyalty and attract new customers.

DMB Legal Protection Insurance is a prime example: they achieved intelligent document processing in record time. With Buildsimple and d.velop, they optimised inbound document processing in just eight months.

Outlook: The Future of AI in Insurance

The development of Agentic AI is still in its early stages. In the future, assistants will not only answer questions but actively manage processes. For example, a system could automatically prepare claim reports, request missing documents, or even make recommendations for claim settlement. “AI could also play a key role in underwriting or risk management,” says Florian Breuer.

For insurers, this means: those who establish the right foundations today and structure their data intelligently will benefit significantly faster from future technologies. Artificial intelligence in insurance is not a short-term trend but a long-term transformation that will shape business models and workflows.

Conclusion: AI as an Opportunity, Not a Replacement

Agentic AI and modern document management are key drivers of digital transformation in the insurance sector. They increase efficiency, strengthen compliance, and elevate customer service to a new level.

The key to success lies in viewing technology as an enabler rather than a threat. AI does not replace people ‒ it supports them. Insurers that invest early and plan strategically will secure not only a technological advantage but also the trust of their customers.

Digital Document Management Easy Explained

Key features, implementation steps, and AI insights – all in one practical guide.