Digitalisation is no longer just a trend – it has become a strategic necessity. Companies that want to remain competitive in a dynamic market environment can no longer avoid the digitalisation of their business processes. One of the most effective levers on the path to a digital future is the automation of invoice processing.

An additional driver of digital transformation is the e-invoicing mandate that came into effect in Germany on 1 January 2025 for business-to-business (B2B) transactions. Since the beginning of the year, companies have been legally required to receive electronic invoices in accordance with the European standard and to archive them in a legally secure manner. This legal requirement makes fully digital and automated invoice processing not only a competitive advantage but also a legal necessity. Those who adopt optimised digital invoice processing early on can ensure compliance, streamline internal processes, reduce errors, and realise cost savings.

What Does Invoice Processing Mean?

Before diving into the details of process optimisation, let’s first clarify the central question: What is invoice processing?

Definition: Invoice Processing

“Invoice processing” refers to the entire workflow involved in handling invoices – from receipt to final posting and payment. The digital implementation of incoming invoice processing is carried out using software solutions such as document management systems (DMS), integrated ERP modules, and specialised workflow tools. These enable the automated capture, verification, and archiving of invoices.

Challenges of Invoice Processing Without Digital Support

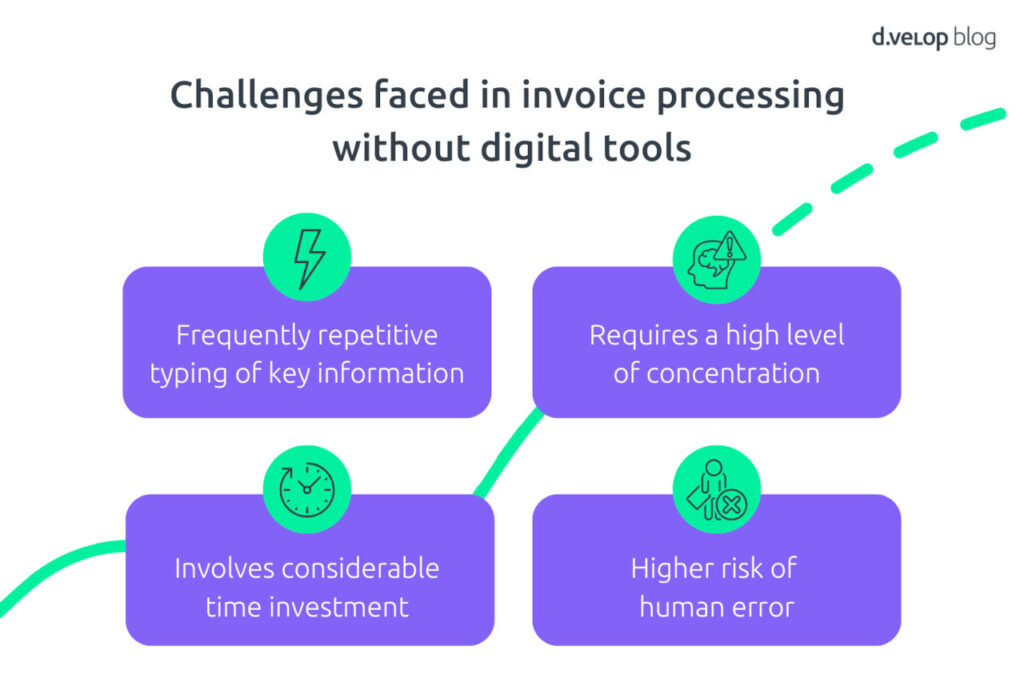

Many companies still struggle with the manual processing of invoices – whether received digitally as PDFs or physically by post. This manual handling presents numerous challenges: these include the often monotonous task of typing in relevant information, the high level of attention required, the significant time investment, and the increased risk of human error. These factors highlight the difficulties that can arise when processing invoices manually.

In order for an invoice to be processed digitally, key header data such as the invoice date, number, amount, etc., must first be manually entered into the ERP or accounting system. Although this task is often monotonous, it still requires a high level of concentration. A simple transposition of digits when entering the supplier number can result in the payment being sent to the wrong supplier.

Another example: entering the wrong invoice date. The mistake is usually only noticed after the first reminder is received. And any chance of claiming an early payment discount is lost by then.

Such errors are difficult to avoid entirely—especially during routine tasks, when human attention tends to decline.

The Solution: Invoice Processing Automation

The answer to these challenges lies in automated invoice processing. Its goal is to ensure that invoices are handled reliably, quickly, and with minimal errors—without the need for manual data entry.

A digital invoice processing solution not only significantly shortens processing times, minimises potential errors, and ensures legally compliant archiving of all invoices in accordance with GoBD and other regulatory requirements, but also improves transparency and control. Every processing step is digitally traceable, allowing users to maintain a clear overview of approvals, deadlines, and payment statuses.

Furthermore, digital invoice processing can usually be seamlessly integrated with all common ERP systems (such as SAP or Microsoft Dynamics) and other specialised applications.

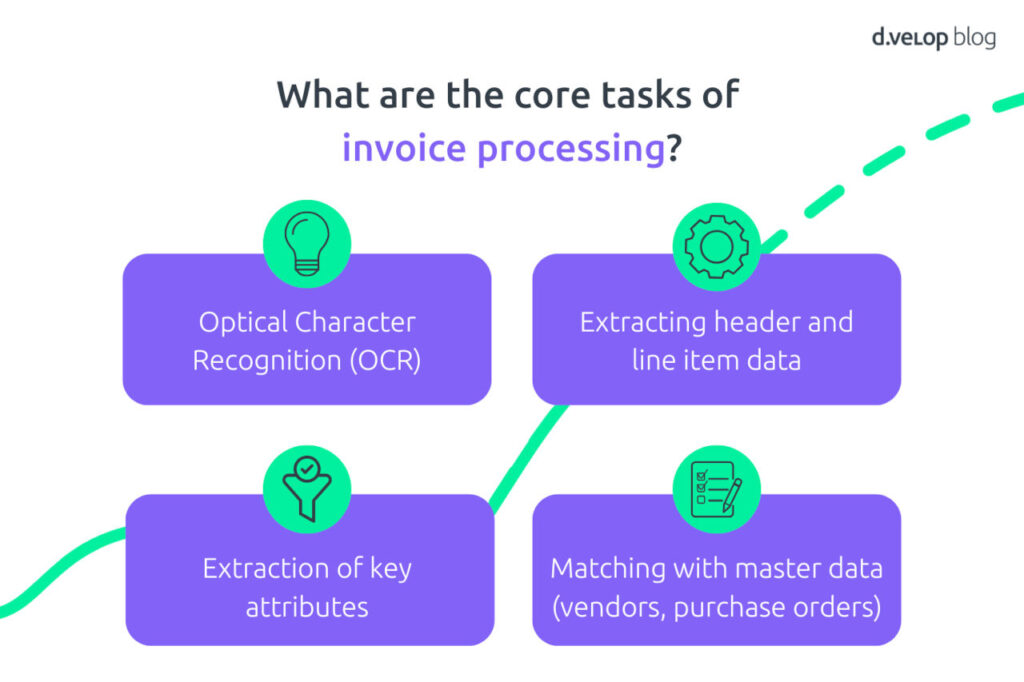

What are the core tasks of invoice processing?

After the invoice is received (either digitally or still on paper), the invoice data is automatically captured and extracted by the software. In the next step, the contents are reviewed either automatically or manually—for example, by matching them with purchase orders or contracts. The invoice is then digitally forwarded to the responsible individuals for further review and approval.

Once approved, the invoice is posted in the ERP system and released for payment. Finally, the invoice is archived digitally in a legally compliant manner, in accordance with GoBD requirements.

Digital invoice processing – tips and pitfalls in project planning

This white paper explains the advantages you gain, the possible obstacles you may face and describes the necessary framework conditions you need to have in place.

How Is Invoice Processing Introduced in a Company?

Initial Preparations

The introduction of invoice processing begins with a thorough analysis of the current state of existing invoice workflows. This involves identifying current procedures, weaknesses, and areas for improvement. Companies then define their specific requirements for the new solution, including legal obligations such as the e-invoicing mandate and individual process preferences.

At the same time, a project team is formed, typically consisting of representatives from departments such as accounting, IT, and procurement, with clearly defined responsibilities. It is equally important to establish concrete project goals and success criteria to ensure measurable progress. Technical prerequisites should also be reviewed early on, particularly regarding the integration of existing ERP systems. Open communication with affected employees and their early involvement in the project help build acceptance and lay the foundation for successful implementation.

Implementation Phase

The implementation of the digital invoice processing project begins with a formal project launch, where all stakeholders gather in a kick-off meeting to define requirements. This is followed by the development of the target process for digital invoice handling and the definition of necessary workflows, such as approval paths and escalation procedures.

Next comes the system setup and integration of the software solution into existing systems like ERP and accounting. During the testing and pilot phase, the solution is thoroughly evaluated using real invoices before being prepared for company-wide rollout. In parallel, all users are trained and provided with the necessary guidance and documentation.

Monitoring

After go-live, the monitoring phase begins. The system is continuously observed and adapted to meet new requirements. The focus here is on long-term maintenance, optimisation, and adjustment to ensure that invoice processing remains efficient, legally compliant, and user-friendly over time.

Conclusion: Invoice Processing as a Key to Digitalisation

Invoice processing is a vital component of a company’s digital transformation. By automating and digitising invoice handling, manual and error-prone processes are made more efficient, costs are reduced, and transparency is increased. Implementing a modern invoice processing solution not only ensures compliance with legal requirements—such as the e-invoicing mandate—but also helps optimise internal workflows, accelerate decision-making, and enhance organisational agility.

As an integral part of a broader digital strategy, invoice processing represents a crucial step towards a more sustainable and future-ready business environment.

With d.velop invoices, we support companies on this journey and help them optimise their invoice processing quickly and efficiently. These are often the first steps towards a fully integrated digital transformation.

💻Book Software Demo

Experience the power of d.velop’s software with a personalised live demo, easily requested with just a few clicks. Watch as the software comes to life before your eyes and ask any questions you may have in real-time.